Charles Hallinan

Charles Hallinan

Charles Hallinan peers through reflections on his closed car window after he was sentenced on July 6, 2018 to 14 years in federal prison.

Charles Hallinan nicknamed "The Godfather of Payday Lending" is a convicted felon and the former Owner of several Online payday lending companies. Halliman's companies charged yearly interest rates and fees as high as 1,825% and got $690 million in revenue starting from 1997 and 2013. In July 2018, Hallinan was sentenced to 14 years in federal prison for evading state regulations against usury by using Native American tribes and a bank as fronts. He was convicted on several charges relating to racketeering and conspiracy. [1]

Education

Charles Hallinan have a Bachelor of Science degree in Finance from New York University and a Masters in Business Administration in Finance from the Wharton School of Business, University of Pennsylvania.

Personal Life

Charles Hallinan's $1.8 million, 8,000-square-foot home in Villanova, Pennsylvania.

Charles Hallinan lived in a $1.8 million, 8,000-square-foot home in Villanova, Pennsylvania. He also owned a $2.75 million lakefront condo in Boca Raton, Florida. Hallinan owned several luxury vehicles including a $142,000 Bentley Continental Flying Spur and two Mercedes Benz.

Charles Hallinan's lawyer, Edwin Jacobs, said that Hallinan had been recently diagnosed with two forms of aggressive cancer during his sentencing hearing on Friday, July 6, 2018.

Career

Investment Banking

Charles Hallinan's $2.75 million lakefront condo in Boca Raton, Florida.

Charles Hallinan began his career in investment banking in 1966 with Reynolds & Company, which evolved through a series of mergers and acquisitions and is now part of Morgan Stanley. He exited the industry after making a $120 million selling a landfill company in the 1990s.

Payday Lending

Charles Hallinan broke into the payday lending industry in the 1990s with $120 million he made after selling a landfill company, offering payday loans by phone and fax. He quickly built an empire of dozens of companies offering quick cash under names like Tele-Ca$h, Instant Cash USA, and Your First Payday, and originated many strategies to dodge regulations that were widely copied by other payday lenders.

During the 1990s more than a dozen states, including Pennsylvania, effectively outlawed payday lending with laws against usury attempting to cap the exorbitant fee rates that are standard across the industry, however Hallinan continued to target low-income borrowers over the internet.

To get around the laws, Hallinan's lawyer, Wheeler Neff, helped him adapt and is quoted in the indictment as suggesting they seek out opportunities in "usury friendly" states.

Hallinan developed a lucrative agreement starting in 1997 with County Bank of Delaware, in Delaware payday lending remained unrestricted. Prosecutors say Hallinan's companies paid County Bank to solicit borrowers in states with strict anti-usury laws and to act as the lender on paper. They had done this under a legal theory that because County Bank was federally licensed it could export its interest rates beyond Delaware’s borders.

In reality, the indictment alleges, Hallinan funded, serviced, and collected all of the loans and paid County Bank only to use its name as a front.

Throughout the trial against Hallinan, prosecutors painted that arrangement as hollow.

Hallinan did little more than rent the bank’s name to hide the fact that his companies based in a Bala Cynwyd, Pennsylvania office park handled every aspect of the operation from lending the money to vetting the borrowers and servicing the loans.

“The whole thing was a farce and a sham,” said Dubnoff in his closing argument.

In 2003, New York Attorney General Elliot Spitzer filed suit against the bank and two of Hallinan's companies, accusing them of violating the state's anti-usury laws. The case was settled in 2008 for $5.5 million, and federal regulators have since ordered County Bank to cease its dealings with payday lenders.

But that did not stop Hallinan.

He began contracting in 2003 with federally recognized Native American tribes, which could claim tribal sovereign immunity.

They reasoned that by partnering with federally recognized tribes, which hold sovereign immunity to set their own regulations on reservation lands, they could continue to operate nationwide.

Much like his arrangement with County Bank, Hallinan paid tribes in Oklahoma, California, and Canada as much as $20,000 a month between 2003 and 2013 to use their names to issue usurious loans across state lines, prosecutors said.

Prosecutors say the tribes did little beyond housing computer servers that Hallinan sent to them to give their operations a sheen of legitimacy. A representative of one tribe with which Hallinan worked — the Northern California-based Guidiville Band of Pomo Indians of the Guidiville Rancheria — testified that he only later found out that the server he had set up in a shipping container on his reservation was devoid of data and was not even connected to the internet.

When plaintiff s’ lawyers and regulators began to investigate these arrangements, Hallinan and Neff engaged in legal gymnastics to hide their own involvement, government witnesses said.

Testifying in a 2010 class action lawsuit in Indiana, Hallinan maintained that he sold the company at the heart of that suit to a man named Randall Ginger, the self-proclaimed hereditary chieftain of the Mowachaht/Muchalaht First Nation in British Columbia.

But evidence presented by prosecutors showed that Hallinan had continued to run the operation and pay its legal bills even while he was paying Ginger to claim the company as his own.

Ginger later asserted that he had almost no assets to pay a court judgment, prompting the case’s plaintiffs to settle their claims in 2014 for a total of $260,000.

That swindle, prosecutors now say, helped Hallinan escape legal exposure that could have cost him up to $10 million.

Ginger also was charged in the case, but remains a fugitive in Canada. The investigation — led by the FBI, the IRS, and the U.S. Postal Inspection Service — has elicited four other guilty Pleas from people tied to Hallinan’s businesses.

Criminal History

Charles Hallinan leaving court after being convicted on all counts in November 2017

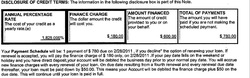

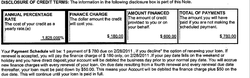

One loan highlighted by prosecutors carried periodic fees that amounted to an annual interest rate of 1,825 percent.

On Friday, July 6, 2018, Charles Hallinan was sentenced to 14 years in federal prison and stripped of more than $64 million in assets.

Charles Hallinan remained unrepentant in the face of a prison term that his lawyers said might as well be a “death sentence” given his age and rapidly declining health.

Hallinan said nothing when given the chance to address U.S. District Judge Eduardo Robreno before his punishment was imposed. In interviews with probation officers before Friday’s hearing in Philadelphia, he said he was “exactly the opposite” of contrite.

“It would be a miscarriage of justice to impose a sentence that would not reflect the seriousness of this case,” Robreno said.

“The sentence here should send a message that criminal conduct like [this] will not pay.”

In November 2017, a federal jury convicted Hallinan of all 17 counts of criminal conduct the government charged in its superseding indictment: two counts of conspiracy to violate the Racketeer Influenced and Corrupt Organizations Act (RICO); one count of conspiracy to commit mail fraud, wire fraud, and money laundering; two counts of mail fraud and aiding and abetting; three counts of wire fraud and aiding and abetting; and nine counts of international money laundering and aiding and abetting.

In court Friday, July 6, 2018 Assistant U.S.

Attorney Mark Dubnoff argued that there was little difference between the exorbitant fees charged by money-lending mobsters and the annual interest rates approaching 800 percent that were standard on many of Hallinan’s loans.

In the state of Pennsylvania payday loans are limited to interest of 6% annually.

Withe fees some of the loans could reach total interest rates as high as 1,825%.

“The only difference between Mr. Hallinan and other loan sharks is that he doesn’t break the kneecaps of people who don’t pay his debts,” Dubnoff said. “He was charging more interest than the Mafia.”

In all, government lawyers estimate, Hallinan’s dozens of companies made $492 million off an estimated 1.4 million low-income borrowers between 2007 and 2013, the period covered by the indictment.

Authorities also estimate that his companies made $690 million in revenue between 1997 and 2013.

Hallinan's lawyer, Edwin Jacobs, said that Hallinan had been recently diagnosed with two forms of aggressive cancer, Jacobs pleaded with Robreno to take the unusual step of granting Hallinan house arrest so that he could receive necessary treatment.

“What is just, under the circumstances?” Jacobs asked.

“If there is going to be a period of incarceration, one that makes it so that Mr. Hallinan doesn’t survive is not just.”

Although Robreno made some accommodations for Hallinan’s health – including giving him 11 days to get his medical affairs in order before he must report to prison – he refused the defense lawyer’s request.

The judge cited the financier’s efforts to obstruct the investigation up to and during his trial as well as the prison system’s ability to care for ailing inmates.

Hallinan helped to launch the careers of many of the other lenders now headed to prison alongside him – a list that includes professional race car driver Scott Tucker, who was sentenced to more than 16 years in prison in January and ordered to forfeit $3.5 billion in assets.

Hallinan’s codefendant and longtime lawyer, Wheeler K. Neff, was sentenced in May 2018 to eight years behind bars.