USD Coin (cryptocurrency)

USD Coin (cryptocurrency)

Circle has partnered with Airtm and the Bolivarian Republic of Venezuela to deliver funds from the United States Department of the Treasury to Venezuelan citizens This is the first in U.S. history where the government will use stablecoin to execute a foreign policy plan. [36]

Overview

On October 23, 2018, well-known and trusted U.S.-based cryptocurrency exchange Coinbase announced support for the USD Coin (USDC), which is a stablecoin that they created in collaboration with Circle Internet Financial. Each USDC issued is backed by a fiat United States dollar held in reserve bank accounts.[3] [28] USDC is an ERC20 Token created on Ethereum Blockchain using a Smart Contract. Anyone can verify it on the blockchain.[6][29]

Founders

USD Explained by Circle

USD Coin is developed by US-based company, Centre Consortium in a partnership with global financial and blockchain technology firm, Circle and one of the leading cryptocurrency exchange Coinbase. Center is an open-source, decentralized crypto-powered consumer payment network and, they enable a more efficient and inclusive global marketplace by removing artificial economic borders. The circle was founded by entrepreneurs, Jeremy Allaire and Sean Neville in 2013 and it enables businesses of any size to harness the power of stablecoins and public blockchains for payments and commerce worldwide. They are officially a money transmitter in the United States and so they comply with federal laws and regulations. There are also rumors that a Circle is backed by global investment banking and investment firm Goldman Sachs. Coinbase is one of the oldest and most trusted cryptocurrency exchanges worldwide.[8][9][10][11][12]

Features

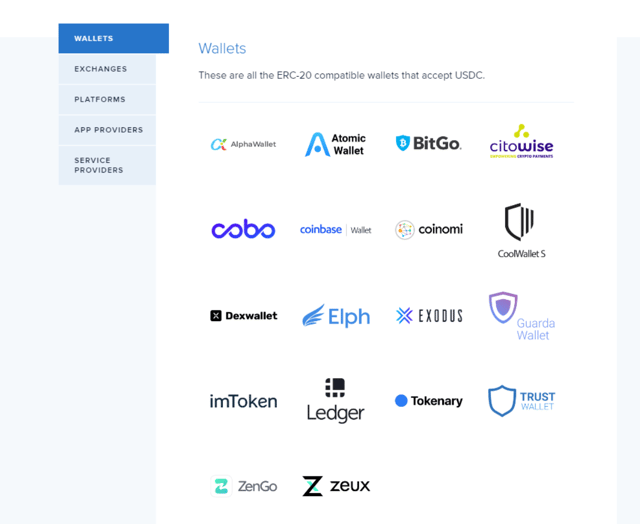

USDC supported wallets

USD coin has many advantages over fiat money and also over other cryptocurrencies.

Some of the features of USD coin are: [31]

Fast Transfer

In the traditional banking system, it can take a long time to send US Dollars to people and institutions.

As USDC is based on blockchain, it offers the stability and desirability of the USD with the speed of cryptocurrency transactions.

Programmable

As it is based on blockchain, it is programmable money.

It opens a new world of applications and businesses: developers can create accounts to store money with one line of code; lending and borrowing that is cheaper, faster, and more transparent.t

can be used for faster and cheaper payments, including payroll, global crowdfunding, transparent and stable donations to charity, etc.

Stability

USDC is fully backed 1:1 to USD and its value always remains constant around USD.

This is very helpful for businesses who want to avoid the volatility of cryptocurrencies but still want to use the benefits of the blockchain.

Transparency and Regulations

USDC an open-source project that works within US money transmission laws and uses established banks and auditors.

This is true financial and operational transparency.

It is backed by a registered Money Transmitter, Circle and it is regulated by the Financial Crimes Enforcement Network ("FinCEN"), which is a bureau of the U.S.

Department of Treasury, as a Money Services Business.

Beyond the U.S., Circle is regulated as an Electronic Money Institution by the Financial Conduct Authority, held accountable to the Treasury (responsible for the UK's financial system) and to the Parliament.

So the issuance of USDC, the equivalent amount of USD is ascertained with one of the Circle’s trusted associates.

All USDC tokens are regulated, transparent, and verifiable on the blockchain.

Security

How USDC produced?

As USDC is an ERC 20 token but pegged to Fiat currency, i.e United States dollar, it cannot be mined like Bitcoin or other minable cryptocurrencies. It is backed by the United States dollar held in reserve bank accounts. In simple words, the USDC Treasury, Centre consortium that mints USDC, collectively holds US$1.00 for every single USDC. These funds are held in a special bank account that is constantly monitored and audited. According to CoinMarketCap, Currently, USDC has a total supply of 1,258,811,239 tokens (with over 1,255,115,653 in circulation (August 2020). It is ranked 18th and has a market capitalization of $1,259,614,742 USD (August 2020).[15][16]

Growth

USDC grew in market cap substantially in the last couple of years and especially in DeFi projects.

Since the introduction of DeFi platforms, especially decentralized exchanges (DEX) like dYdX, DApps like Aave, liquidity pools like Uniswap, Wallets like Cobo Wallet, Dexwallet, USDC has seen a huge growth in volume.[19]

Partnership with the US Treasury, Boliverian Republic of Venezuela, and Airtm

On November 20, 2020, Circle announced a partnership with the Boliverian Republic of Venezuela and Airtm. The parties are to work together to deliver aid to Venezuelans using USDC, as the United States Department of the Treasury has had previous issues with sending funds to Venezuelan residents as a result of Nicolás Maduro blocking this aid.[35][36] In a blog post, the company stated,

Through a collaboration with the Bolivarian Republic of Venezuela, led by President-elect Juan Guaido, U.S.-based fintech innovator Airtm, and coordination and licensing with the US government, we were able to put in place an aid disbursement pipeline that leveraged the power of USDC — dollar-backed, open, internet-based digital currency payments — to bypass the controls imposed by Maduro over the domestic financial system and put millions of dollars of funds into the hands of people fighting for the health and safety of the people of Venezuela.[35]

Funds from the U.S.

Treasury will flow through a business account Airtm has with Circle.

From there, USDC can be sent to any mobile digital wallet. Airtm has over half a million users in Venezuela alone. Doing this will allow the U.S. government to bypass the Venezuelan banking system, which is controlled by the country.[36]

Competition

Before the introduction of USDC, the cryptocurrency world did not have many options in the stable coin market apart from Tether (USDT). USDT still has been the most popular stablecoin and ranked currently in the top 5 cryptocurrencies on CoinMarketCap. Since its launch in 2018, USDC has progressed well and has achieved an image of the most trustworthy stablecoin. It was ranked 57th in November 2018 and now it has achieved a place in the top 20 cryptocurrencies. There are so many other stablecoins (pegged to USD) are launched in recent years including Dai, EOSDT, USDX, etc. There are many other types of stablecoins like PAXG, XAUT also play part in the stablecoin market. [17][18]