Swerve Finance (cryptocurrency)

Swerve Finance (cryptocurrency)

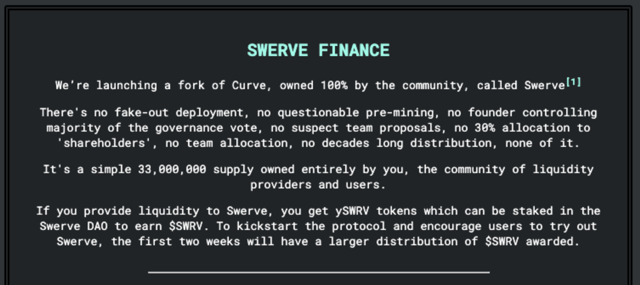

Swerve Finance (Cryptocurrency) is an unaudited fork of Curve Finance, a DeFi exchange liquidity pool on Ethereum designed to be owned and governed by the community and liquidity providers that use it. [2][3][5][6][7] $SWRV aims to make token distribution and governance more equal with a 100% community-owned governance token. [2][8]

The protocol was founded by an anonymous developer named John Deere and launched on September 5, 2020.

After launch, Swerve locked up $520M in 4 days, which about 50% of the total value locked (TVL) in Curve, launched in January 2020. [2][10][11][22]

Overview

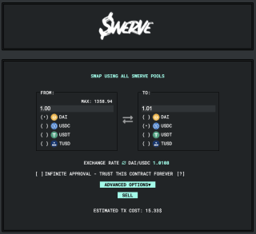

Swerve App Showing Pools

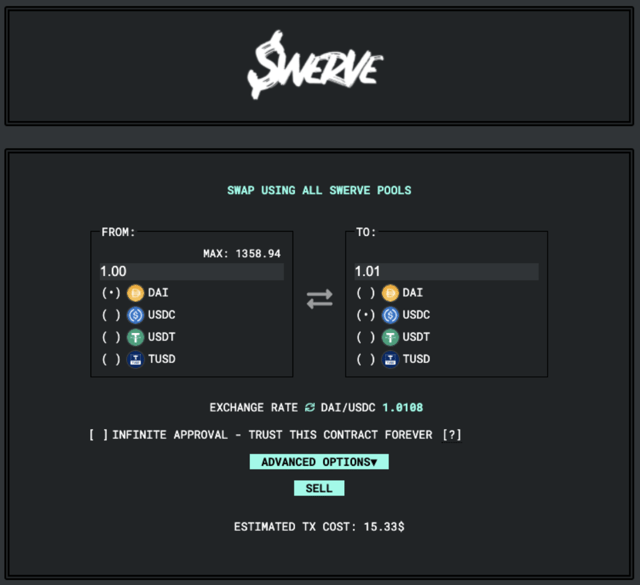

Screenshot from Swerve Finance Website

Screenshot from Swerve Finance Website

Swerve is a clone of Curve Finance only without a pre-mine, token allocation to shareholders, and extended distribution of tokens. Swerve has a single pool that accommodates leading stablecoins such as DAI, TUSD, USDT, and USDC. The creation of new pools is a function of the protocol’s DAO. [1]

As such, the community can vote to introduce additional pools. Unlike other DeFi platforms, Swerve does not whitelist smart wallets allowing projects like yEarn and other DeFi based smart contracts to participate in its votes. [22]

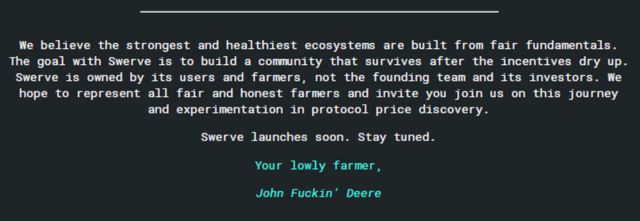

"The goal with Swerve is to build a community that survives after the incentives dry up.

Swerve is owned by its users and farmers, not the founding team and its investors.

We hope to represent all fair and honest farmers and invite you join us on this journey and experimentation in protocol price discovery."

Tokenomics

Protocol

Swerve’s native token is called Swerve token (SWRV) and it is supplied to the community without a reserve for founders or the team.

SWRV has a circulating supply of 8,541,319 SWRV tokens, and a maximum supply of 33,000,000 tokens, which are unlocked on a yearly basis, with all coins going to holders, liquidity providers, and users. Swerve has a market cap of $6,544,752 USD. Some exchanges for trading in Swerve are currently Binance, Huobi Global, BIKI, and OKEx. [14][21]

If holders provide liquidity to Swerve, they get ySWRV tokens which can be staked in the Swerve DAO to earn SWRV. The holders of the Swerve token are in entire control of the Swerve DAO. The DAO will be the owner of all the protocol contracts, and all changes to the protocol or DAO must be voted on and approved by SWRV holders. [15][20]

"Swerve will initially deploy with just one pool, the Y Pool [DAI, USDC, USDT, TUSD] and leave the addition of future pools up to the decision of the DAO.

The Y Pool on Curve generally the most in demand and has 60-70% of the TVL, and we want the providers to be able to decide which pools they want to exist and participate in instead of launching with and allocating rewards to additional pools they may or may not actually want to provide liquidity for.

The Y Pool will be exactly the same.

"

"We hope it will solve a common initial farming problem, where providers are paying high gas costs to hop between many pools in search of the highest yields (in result, not actually providing liquidity for their intended or ideal pair or pool)."

Token Distribution

The first distribution of nine million SWRVs occurred 2 weeks after launch.

To kickstart the protocol and encourage users to try out Swerve, the first two weeks will have a larger distribution of $SWRV awarded.[2] In the first year, liquidity providers will receive another 9 million SWRV tokens.

The remaining 15 million tokens will then be equally spread over five years at a rate of 3,000,000 tokens per year.

First 2 weeks: 9,000,000 SWRV

Year 1 (after the 2 weeks): 9,000,000 SWRV

Year 2: 3,000,000 SWRV

Year 3: 3,000,000 SWRV

Year 4: 3,000,000 SWRV

Year 5: 3,000,000 SWRV

Year 6: 3,000,000 SWRV

Total: 33,000,000 SWRV [11]

Audits

At launch on September 5, 2020, there were no public audit reports of the Swerve protocol.

On September 14, 2020, Cryptic Labs completed an audit of Swerve's code and found no defects.

The report reviewed Swerve Contract codes and did not include reviews for the swerve-web and swerve-ui codes.

Swerve vs. Curve

Curve Finance launched in January 2020 and has grown to lock over $1 billion in user value, making it the second most popular Decentralized Exchange (DEX) behind Uniswap.

Swerve Finance combines two emerging trends in DeFi. The first is the forking of existing open-source protocols to launch modified versions of the original product. The second is the radical experimentation in full community governance in projects such as yEarn Finance. [5][18]

Community Responses

Andre Cronje Tweet

After launch, yEarn founder Andre Cronje tweeted his support of $SWRV. He mentioned Swerve Finance’s design was “very intriguing” and stated:

“What Swerve did was add a proxy sample, so the implementation is the copyright curve contract.

However the storage is Swerve.

This abides by the copyright, but additionally permits a full characteristic fork.

Each from authorized and technical perspective, that is actually sensible.”