Pickle Finance (Cryptocurrency)

Pickle Finance (Cryptocurrency)

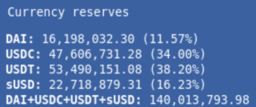

Pickle Finance (Cryptocurrency) brings the four largest stablecoins (DAI, USDC, USDT (Tether), sUSD) closer to their peg by using the power of yield farming and pVaults. [8] [14] [17] $PICKLE has in the past accrued more than $347 million in Total Value Locked (TVL) since launch. One of the primary Liquidity pools is offering up to 4,500% APY. [17] [18] [19]

Introduction

$PICKLE Motivation

Stablecoins have often gone off peg due to varying market conditions and limitations in monetary policy. The recent boom in yield farming has only exacerbated this problem as farmers buy and sell large amounts of stablecoins in order to chase the best yield. [12]

A much more stablecoin ecosystem is required for the DeFi (Decentralized Finance) ecosystem to flourish,. [12]

Elastic Farming Incentivization

The $PICKLE protocol empowers farmers to leverage their yield-seeking tendencies to help the DeFi ecosystem maintain the pegs of the four largest stablecoins: Dai (cryptocurrency), USDC, USDT, and sUSD. [12]

The protocol will distribute fewer $PICKLE to that pool and more $PICKLE to other pools when a stablecoin is above peg.

As yield farmers chase the best yield, this creates sell pressure for the overvalued stablecoin and buy pressure for the other coins.

This works in reverse for stablecoins that are below peg.

The initial distribution of PICKLEs is based on Curve Finance’s sUSD pool. [12] Future distributions will be done via a timelock contract, with input from the governance community. [12]

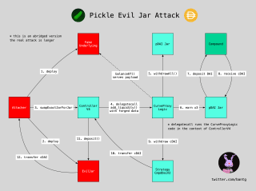

Pickle Exploit

On November 21, 2020, it had been reported that Pickle Finance had suffered a security compromise in its protocol.

$20 million was seized out of the firm's cDAI jar.[25] A day after the incident was reported, the firm let its community know that deposits in other jars were allowed to be used safely again, but the DAI Jar still remains dangerous to use.[26]

Technical details of the hack were also posted on November 22 to GitHub. The cause was that the hackers had taken advantage of various flaws within the system, particularly with Jar swap and Jar convert logic. The attackers crafted what Pickle called an "Evil Jar", which took advantage of the exploits and created a FakeUnderlying contract.[27]

$PICKLE Protocol

pVaults short for Pickle Vaults, utilizes different active strategies including leveraged flash loans to short off-peg stablecoins, to generate returns for pVault owners and the protocol. $PICKLE is also used for governance to control the monetary policy of the protocol. [12]

Auditing Status

Pickle finance has undergone a series of audit reports from third parties, most recently from MixBytes around early November 2020.

The firm was last reported to be waiting for a final report from MixBytes that covers the entire smart contract suite.[22]

Liquidity Providers

The $PICKLE token will be provided to liquidity providers of four stablecoin pools:

DAI/ETH

USDC/ETH

USDT/ETH

sUSD/ETH

More rewards are given to below-peg stablecoin pools and fewer rewards are given to above-peg stablecoin pools.

This gets people to sell above-peg stablecoins and buy below-peg stablecoins.

$PICKLE will also give rewards to an ETH-PICKLE pool.

This takes care of the case where all stablecoins are above peg.

There will likely be other pools as well.

Pickle Swap

The $PICKLE website has a "Pickle Swap" feature for yield farmers to chase the highest yield between pools.

Using the “Pickle Swap” feature, a user can change their LP position from one stablecoin pool to another in a single click.

The ease of swapping will help off-peg stablecoins return to their peg faster.

PickleJars

Each PickleJar employs a different strategy to seek "alpha" for liquidity providers. [20]

4 PickleJars have been deployed so far:

pJar 0: The sCRV Jar, which farms CRV

pJar 0.69a, b, & c: The UNI Jars, which farms UNI

Within 3 days, we already have $10M locked in our Jars.

In November, Pickle Finance introduced PickleJar Zapping, which is a yield farming method that is built for those new to farming.

With the 'Jar Zapping' feature, users can begin to earn compounding yield by depositing their tokenized BTC or stablecoins and then simply confirming a few transactions.[22]

pVaults

There were 2 vault strategies at launch.

The first was allowing liquidity providers to deposit sCRV to earn CRV tokens, and then selling the CRV tokens for the least supplied stablecoin to earn additional sCRV.

The second strategy used flash loans to leverage up and arbitrage between stablecoin while generating a return for the vault owners. There will be a separate blog post on the mechanisms of pVaults in the future. [12]

$PICKLE Governance

$PICKLE holders have the power to shape the future of the protocol.

A dedicated on-chain governance forum will be live a few days after the protocol launch to enable decentralized community control. The governance process works by having users vote with their $PICKLE tokens. In the short future, quadratic voting will be introduced for a more democratic form of governance. [12]

Quadratic voting

Quadratic voting will take the Square root of each vote instead of counting it nominally to prevent whales from having too much influence. The project’s governance structure prompted a response from Ethereum founder Vitalik Buterin himself. [15]

Development fund

2% of each $PICKLE distribution will be set aside for future development and iterations while giving an opportunity for the team to work full time on the project.

Beyond security audits, the team would like to contract out an analysis of a more equitable inflation schedule and the building of a more comprehensive governance portal among other UI/UX improvements. [12]

$PICKLE Token

1 $PICKLE is distributed per block across the four stablecoin/ETH pools and the PICKLE/ETH pool.

50% of the reward is dedicated to the PICKLE/ETH pool, while the other four stablecoin/ETH pools share the remaining 50%.

At launch, there will be a 10x multiplier to reward early adopters of the Pickle Protocol, meaning 10 PICKLEs are distributed per block for two weeks.

The $PICKLE Protocol will adopt a fair incentive distribution, meaning no venture capitalists, no pre-mine, no Initial Coin Offering (ICO), and staking prior to reward distribution. [12]

$PICKLE distribution started on block 10838600, around September 11, 2020, 5:00 A.M. UTC.

Protocol Updates

PickleFarms

One week after launch, $PICKLE's passive stablecoin stabilization farm experiment grew from $20M TVL on day 0 to $350M+ TVL at its peak.

Dai Price

The price of DAI went from $1.05 to $1.01.

In a Medium announcement posted on September 19, 2020, the team stated that they can't say definitively this was because of Pickle. They would like to think their experiments contributed to bringing stablecoins back to peg. [20]

pJars

A brand new active strategy, pJar 1.0 The Leveraged-Short DAI pJar, will be launching in the coming weeks.

PICKLE rewards for pJars 0, 0.69a, 0.69b, and 0.69c. PICKLE rewards will be rolled out to the pJars such that liquidity providers can earn PICKLEs on top of their return.

Blue Pickle

The Pickle Finance team will also introduce Blue Pickle to the community.

Governance Token

$PICKLE will release a Discourse forum in the near future.

The team stated that Discord (software) channels might not be the best place to examine complex ideas, and longer-form discussions are necessary to help chart the best course for Pickle Finance. Discourse and Snapshot. pages will soon be the new home to all things governance for Pickle Finance. [20]