Nikolai Mushegian

Nikolai Mushegian

Nikolai Mushegian is a blockchain personality. He is a Software consultant and Venture capitalist. He is a programmer and technical Angel investor with a focus on web 3.0 apps and protocols. He is also the founder of Balancer, a protocol for programmable liquidity, and a former technical partner for the MakerDAO project. [1][2][3][4]

Achievements

Nikolai has been involved in several blockchain projects and some of his successful projects include developing best practices for earned value management programming as part of dappsys. These include DSProxy delegatecall-based dynamic atomic composition , DSNote generic logging utility , DSAuth flexible authorization pattern , WETH, and the number 1 contract by Ether balance .

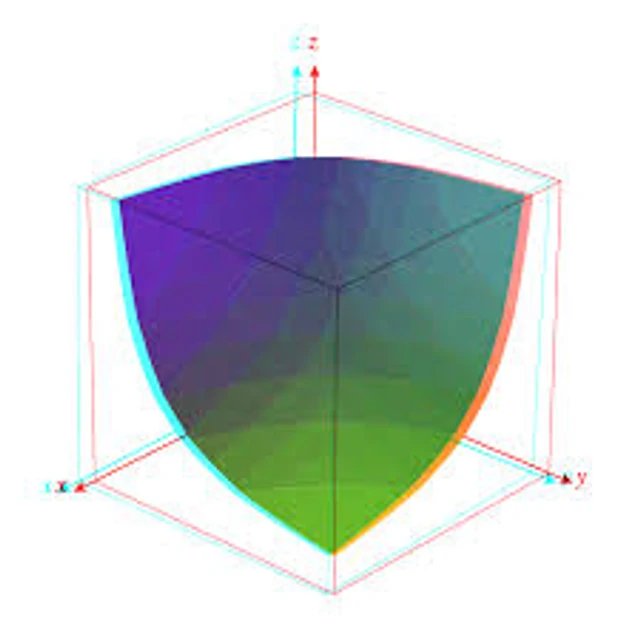

He has also been part of architecting the original Maker/Dai contract system and creating the first implementation of the Balancer Automated Market Maker

Education

Nikolai is a graduate of Computer Science from Carnegie Mellon University. He obtained a bachelors degree in 2014.

Work Experience

Nikolai worked as a software engineer with @Google from June 2015 to August 2015 , where he worked on improving internal corporate tools.

He was a core developer for BitShares (BTS) located in Blacksburg, Virginia, from May 2014 to February 2015 .

He was part of a small team that developed a next-generation blockchain architecture that demonstrated record-setting transaction throughput.

Contributions Towards DeFi Research

Nikolai Mushegian donated 3,200 MKR tokens (currently worth about $1.38 million) to his alma mater - Carnegie Mellon University (CMU).

Mushegian said the purpose of his donation is to set up a research program for Decentralized Finance ( DeFi) protocols and decentralized applications (dapps). The funds will be utilized for sponsoring research of Masters and Ph.D. students. The research agenda and a concrete plan of action are expected to get published over the next few weeks.

On his motive behind the donation, Mushegian said,

“I am very concerned about the increasing rent-seeking behavior from some of the big players in this space, and also from existing banks and tech giants.”

Mushegian believes that DeFi systems will eventually replace the financial backbone of the economy.

“If you thought someone eating your lunch was bad, imagine if you discovered that ‘generalized Uniswap’ was patented.

It will only get worse,”

he stated, adding that such systems belong in the public domain.