Money Multiplier Effect

Money Multiplier Effect

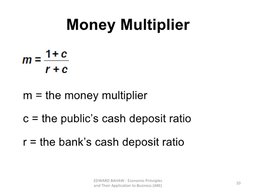

The money multiplier effect is a financial phenomenon whereby the total money in circulation is amplified through banking policies.

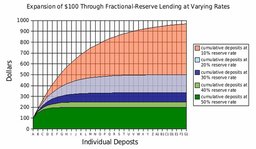

It is the direct result of the fractional reserve banking system, which allows banks to lend a portion of their customers' deposits back into the market, creating a cycle wherein money is re-deposited into the banking system, then re-lent to other customers ad infinitum.

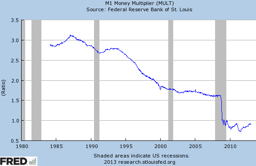

The lender of last resort is needed to instill confidence and begin the equation.

In the United States of America, the lender of last resort is known as The Federal Reserve.

Example:

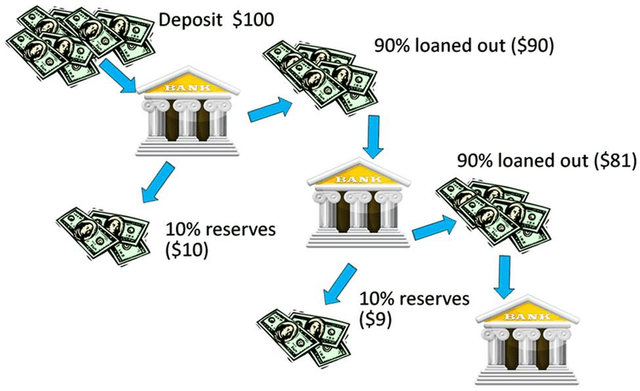

Suppose John deposits $100 into his bank, and they have a 10% reserve requirement.

Then, Lisa goes to the bank and takes out a $90 loan to pay for her groceries at a market, and so the bank must keep $10 in reserve.

The salespeople at the market will then take this money and deposit it into the bank, who may repeat this up to a certain multiple, dictated largely by the reserve requirement.