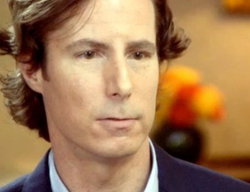

Andrew Madoff

Andrew Madoff

Andrew H. Madoff, brother of Mark Madoff and the last surviving son of the convicted swindler Bernie Madoff, died on Wednesday in a Manhattan hospital, where he had been undergoing treatment for cancer. [0]Mark was 48. [0] [1]

A family lawyer, Martin Flumenbaum, said the cause was mantle-cell lymphoma, for which Mr. Madoff had been treated since early 2013.

His older brother, Mark, committed suicide in 2010.

The two brothers attracted worldwide attention in December 2008 after they alerted federal agents that their father, a respected Wall Street statesman, had confessed to them that his private investment management business was a vast Ponzi scheme.

Based on that report, the senior Mr. Madoff was arrested the next morning, Dec. 11, 2008.

After the arrest, it became clear that his fraud was one of the largest Ponzi schemes in history, with paper losses of almost $65 billion, cash losses of about $17 billion and tens of thousands of victims ranging from Swiss private bankers to labor union pension funds to notable charities and universities.

Bernard Madoff, 76, pleaded guilty in March 2009 and is serving a 150-year sentence in a federal prison in North Carolina.

Prosecutors estimated the size of the Bernard L. Madoff Investment Securities fraud to be $64.8 billion, based on the amounts in the accounts of Madoff's 4,800 clients as of November 30, 2008. [-1]

Background of Andrew Madoff

Andrew Madoff was born on April 8, 1966, and grew up in Roslyn, on Long Island.

He joined his father’s closely held wholesale trading house, Bernard L. Madoff Investment Securities, right after graduating from the Wharton School at the University of Pennsylvania in 1988.

He worked alongside his brother at the firm’s trading desk in the Lipstick Building, on Third Avenue near 53rd Street, two floors away from the secretive money managementoperation at the heart of his father’s long-running fraud.

After Bernard Madoff’s arrest, both sons denied any knowledge of the scheme, which federal prosecutors later said had probably begun when they were children.

No criminal charges were ever filed against them.

But civil litigation filed by the bankruptcy trustee seeking assets for their father’s victims accused them of knowing about the fraud or deliberately turning a blind eye to it.

In the only judgment rendered so far, a British judge in 2013 rejected the trustee’s case there against the Madoff sons, affirming their “honesty and integrity” and ruling that there was no evidence that they were involved in the crime.

Neither of his sons ever visited the senior Mr. Madoff after his arrest, and just last year, Andrew Madoff told a writing seminar at Princeton University, “My father is dead to me.”

In an earlier interview, he told The New York Times that his father’s fraud was “a father-son betrayal of biblical proportions.”

But the suspicion and harsh publicity that followed the arrest became a heavy burden for the family.

In December 2010, on the second anniversary of the arrest, Mark Madoff hanged himselfin his Manhattan apartment, sending a last note to Mr. Flumenbaum contending that “no one wants to believe the truth.”

Andrew, too, acknowledged the damage the case inflicted on him, blaming it for the return in December 2012 of the cancer he had fought off in 2003.

“One way to think of this is the scandal and everything that happened killed my brother very quickly,” he said in a People magazine interview last year.

“And it’s killing me slowly.”

But unlike his brother, Andrew refused to cringe from the spotlight or hide from critics.

He helped his fiancée, Catherine Hooper, build a consulting firm to advise others on dealing with life-shattering developments.

He joined with Ms. Hooper and his mother, Ruth Madoff, in promoting an authorized family biography, which was published in fall 2011.

When his cancer returned, he detailed his experience with stem-cell transplant treatments in a private blog made available to family and friends.

After a series of optimistic reports, the final blog post, dated Aug. 9, noted that he had been hospitalized again but also said that he and Ms. Hooper had taken advantage of the summer’s beautiful weather to take several hiking trips.

“Getting away from the city crowds and breathing fresh, clean air is a godsend for me,” he wrote.

“I can feel my body healing as I drink it in.”

Besides his fiancée, Mr. Madoff is survived by his mother, his father and two daughters from a former marriage, Anne and Emily.

Madoff investment scandal

The Madoff investment scandal was a major case of stock and securities fraud which was discovered in late 2008.

In December of that year, Bernard Madoff, the former NASDAQ Chairman and founder of the Wall Street firm Bernard L. Madoff Investment Securities LLC, admitted that the wealth management arm of his business was an elaborate Ponzi scheme.

Madoff founded the Wall Street firm Bernard L. Madoff Investment Securities LLC in 1960, and was its Chairman until his arrest. The firm employed Madoff's brother Peter as Senior Managing Director and Chief Compliance Officer, Peter's daughter Shana Madoff as rules and compliance officer and attorney, and Madoff's sons Andrew and Mark. Peter has since been sentenced to 10 years in prison, and Mark committed suicide by hanging exactly two years after his father's arrest.

Alerted by his sons, federal authorities arrested Madoff on December 11, 2008.

On March 12, 2009, Madoff pleaded guilty to 11 federal crimes and admitted to operating the largest private Ponzi scheme in history.

On June 29, 2009, he was sentenced to 150 years in prison with restitution of $170 billion.

According to the original federal charges, Madoff said that his firm had "liabilities of approximately US$ 50 billion". Prosecutors estimated the size of the fraud to be $64.8 billion, based on the amounts in the accounts of Madoff's 4,800 clients as of November 30, 2008. Ignoring opportunity costs and taxes paid on fictitious profits, half of Madoff's direct investors lost no money.

Investigators have determined others were involved in the scheme.

The U.S. Securities and Exchange Commission (SEC) has also come under fire for not investigating Madoff more thoroughly; questions about his firm had been raised as early as 1999. Madoff's business, in the process of liquidation, was one of the top market makers on Wall Street and in 2008, the sixth-largest.

Madoff's personal and business asset freeze created a chain reaction throughout the world's business and philanthropic community, forcing many organizations to at least temporarily close, including the Robert I. Lappin Charitable Foundation, the Picower Foundation, and the JEHT Foundation.