Chicago Bridge & Iron Company

Chicago Bridge & Iron Company

Type | Public |

|---|---|

| Traded as | NYSE: CBI [52] |

| Industry |

|

| Founded | 1889 |

| Founder | Horace E. Horton |

| Headquarters | The Hague, Netherlands |

Area served | Worldwide |

Key people | Michael L. Underwood (Chairman of the Audit Committee) L. Richard Flury (Non Executive Chairman of the Board of Supervisory Directors Patrick K. Mullen (President & CEO) |

| Revenue | |

Operating income | |

Net income | |

| Total assets | |

| Total equity | |

Number of employees | 40,000 (June 2017)[3] |

| Website | www.cbi.com [53] |

CB&I administrative headquarters

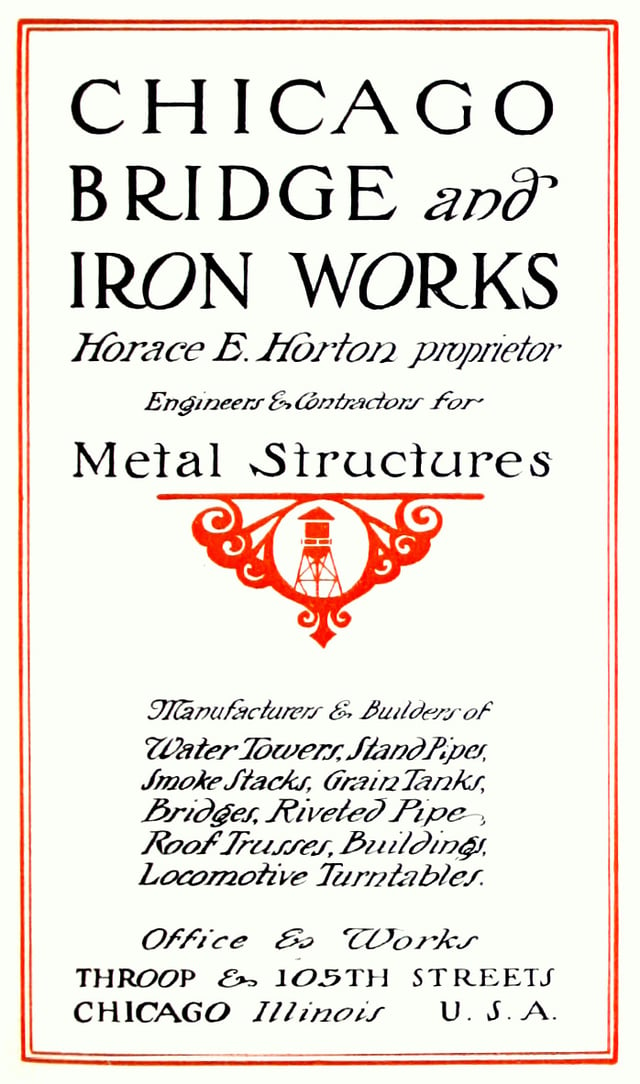

Chicago Bridge & Iron Works, 1912 catalog

CB&I was a large engineering, procurement and construction (EPC) company with its administrative headquarters in The Woodlands, Texas. CB&I specialized in projects for oil and gas companies.[4] CB&I employed more than 32,000 people worldwide.[5] In May 2018 the company merged into McDermott International.[6][7]

Type | Public |

|---|---|

| Traded as | NYSE: CBI [52] |

| Industry |

|

| Founded | 1889 |

| Founder | Horace E. Horton |

| Headquarters | The Hague, Netherlands |

Area served | Worldwide |

Key people | Michael L. Underwood (Chairman of the Audit Committee) L. Richard Flury (Non Executive Chairman of the Board of Supervisory Directors Patrick K. Mullen (President & CEO) |

| Revenue | |

Operating income | |

Net income | |

| Total assets | |

| Total equity | |

Number of employees | 40,000 (June 2017)[3] |

| Website | www.cbi.com [53] |

History

CB&I was founded in 1889 by Horace E. Horton in Chicago, Illinois, USA. While initially involved in bridge design and construction, CB&I turned its focus to bulk liquid storage in the late 19th and early 20th centuries, coinciding with the western expansion of railroads across the United States and the discovery of oil in the Southwest. CB&I quickly became known for design engineering and field construction of elevated water storage tanks, above-ground tanks for storage of petroleum and refined products, refinery process vessels and other steel plate structures. As such, CB&I supported the expansion of oil exploration outside the US, starting operations in South America in 1924, in Asia two years later and in the Middle East in 1939.

According to one of the founder's heirs, "The old joke is that Chicago Bridge & Iron isn't in Chicago, doesn't build bridges and doesn't use iron."[4]

During World War II, CB&I was selected to build Landing Ship Tanks (LSTs), which carried troops and supplies to American and Allied troops fighting in Europe and the Pacific theater. CB&I was chosen because of their reputation and skills, particularly welding. Since the coastal shipyards were busy building large vessels for the war effort, such as aircraft carriers, battleships, cruisers and destroyers, there was no alternative but to use the inland waterways and shipyards for the production of smaller ships.[8] As a result of these and other wartime production activities, CB&I ranked 92nd among US corporations in the value of World War II military production contracts.[9]

CB&I has been involved in a number of changes during the past two decades. It was acquired by Praxair in 1996; Praxair kept a chemical subsidiary and spun off CB&I as a Dutch-incorporated company the next year.[4] CB&I headquarters moved from Chicago to Houston, Texas in 2001 and then to the Hague, Netherlands when Texas enacted a franchise tax.

Since 2000, it acquired a number of companies. In 2003 it bought John Brown Hydrocarbons, renaming it at first CB&I John Brown, and later CB&I UK Limited.[10]

In 2012, CB&I agreed to buy The Shaw Group for about US$3 billion,[11][12][13] completing the acquisition in February 2013.[14] The subsidiary that was formed as a result, CB&I Stone Webster—a result of The Shaw Group's earlier acquisition of Stone & Webster during its bankruptcy—was again sold, in January 2016, to Westinghouse Electric Co., for US$ 229M.[15]

In May 2018 the company merged into McDermott International.[16]

Corporate headquarters and leadership

Historic structures

The company built bridges and other works of historic importance, including some listed on the National Register of Historic Places.[19] These works include (with varying attribution):

Boiling Nuclear Superheater (BONUS) Reactor Facility, Punta Higuero Sector, PR 413, Rincon, Puerto Rico (Chicago Bridge Co. Nuclear Engineering), NRHP-listed[20]

One or more works in the Caplinger Mills Historic District, junction of Washington Ave. and the Sac River, Caplinger Mills, Missouri (Chicago Bridge Co.), NRHP-listed[21]

Embarras River Bridge, Wade Township Rd. 164 over Embarras River, Newton, Illinois (Chicago Bridge Co.), NRHP-listed[22]

Evansville Standpipe, 288 N. 4th St., Evansville, Wisconsin (Chicago Bridge & Iron Co.), NRHP-listed[23]

Hartford Water Tower, Pine & 1st. Sts., Hartford, Arkansas (Chicago Bridge & Iron Co.), NRHP-listed[24]

Lake Ditch Bridge, junction of Lake Ditch and Lake Ditch Rd., Monrovia, Indiana (Chicago Bridge and Iron Co.), NRHP-listed[25]

Mahned Bridge, Mahned Rd. over the Leaf River, New Augusta, Mississippi (Chicago Bridge and Iron Company), NRHP-listed[26]

Manning Water Tower, 620 3rd St., Manning, Iowa (Chicago Bridge and Iron Co.), NRHP-listed[27]

McCrory Waterworks, junction of N. Fakes and W. Third, McCrory, Arkansas (Chicago Bridge & Iron Works), NRHP-listed[28]

Mill Race Bridge, Pheasant Rd. over Turkey River, West Union, Iowa (Chicago Bridge and Iron Co.), NRHP-listed[29]

Monette Water Tower, SW. corner junction of AR 139 & Texie Ave., Monette, Arkansas (Chicago Bridge & Iron), NRHP-listed[30]

Otranto Bridge, 480th Ave. over Big Cedar River, St. Ansgar, Iowa (Chicago Bridge and Iron Company), NRHP-listed[31]

Tyronza Water Tower, NW of junction of Main St. and Oliver St., Tyronza, Arkansas (Chicago Bridge & Iron Works), NRHP-listed[32]

Water Street/Darden Road Bridge, Over St. Joseph River at Darden Rd., South Bend, Indiana (Chicago Bridge & Iron Co.), NRHP-listed[33]

West Water Tower and Ground Storage Tank, 310 11th Ave., Orion, Illinois (Chicago Bridge & Iron), NRHP-listed[34]

CB&I, 2000-present

In late 2000, CB&I embarked on acquisitions that have expanded its services to the entire hydrocarbon industry: conceptual design, technology licensing; engineering and construction; final commissioning and technical services. The firm acquired Lummus Global from ABB on November 19, 2007, adding approximately 3,000 employees.[35][36] CB&I acquired The Shaw Group in 2013, adding pipe, steel and module fabrication services and engineering and construction capabilities in the power generation industry—both fossil and nuclear construction. .Company Press Release [54] In 2015, CB&I sold their Nuclear Construction division to Westinghouse Electric Company, a subsidiary of Toshiba, for $229 million.[37] For 2017, revenue for CBI was $6.7 billion, down from the year before.[1]

As of July 2017, CB&I's global business groups were:

Technology: licensed process technologies, catalysts, specialized equipment and engineered products for use in petrochemical facilities, oil refineries and gas processing plants;

Engineering & Construction: engineering, procurement, fabrication and construction of major energy infrastructure facilities;

Fabrication Services: fabrication capabilities for piping, structural steel, module prefabrication and assembly, as well as storage tanks and vessels for the oil and gas, water and wastewater, mining and power generation industries

After being acquired by McDermott, CB&I's stock ceased being listed on the NYSE on May 11, 2018. Gary P. Luquette was the chairman of the combined company.[38]

Recent major projects

Examples of recent major projects around the world include:

LNG liquefaction plant in Pampa Melchorita, Peru;[39]

Natural gas processing and treating complex in Cabinda Province, Angola;

Crude vacuum and decoking unit expansion project for a refinery in Kansas, US;

Golden Pass LNG import terminal near Sabine Pass, Texas, US;

Large tankage facility at Shell Pearl GTL, Qatar;

Hydrotreating and sulfur removal/recovery facilities for several major US refiners;

LNG re-gasification terminal at Quintero Bay, Chile;[40]

Cat gas hydrotreater (CGHT) in El Paso, Texas, US;

Hydrogen generation plant in Benecia, California, US;

Propane dehydrogenation unit in Houston, Texas, US;

Multiple Middle East storage facilities; and

Oil sands storage tanks in Alberta, Canada.

In November 2004, CB&I was awarded a contract by one of the world's largest suppliers of wind turbines to fabricate 150 tubular steel support towers for wind turbines that were installed in wind farms in the western United States. The towers support 1.5-megawatt wind turbines, which are the largest wind turbines assembled in the United States and the most widely sold and tested megawatt-class wind turbines in the world. In April 2012, CB&I was awarded a contract for a petrochemicals expansion project in Geismar, Louisiana, including the license and basic engineering for the ethylene technology.[41]

In 2012, CB&I Technology (formerly Lummus Technology) was awarded a contract by Indian Petrochemicals major,[42] Reliance Industries to design to provide paraxylene (PX) technology for an aromatics complex in India. The complex is one of the largest of its kind, has capacity to make 2.2 MMTPA of Paraxylene. The complex was started up in April 2017.[43] With the start-up of this complex, Reliance is now the 2nd largest world producer of Paraxylene.[43]

Controversy

CB&I was revealed as a subscriber to the UK's Consulting Association, exposed in 2009 for operating an illegal construction industry blacklist; CB&I was one of 14 companies issued with enforcement notices by the UK Information Commissioner's Office.[44] A CB&I employee consulted the blacklist more than 900 times in 2007 alone, a 2010 employment tribunal was told.[45]