Arrow–Debreu model

Arrow–Debreu model

In mathematical economics, the Arrow–Debreu model suggests that under certain economic assumptions (convex preferences, perfect competition, and demand independence) there must be a set of prices such that aggregate supplies will equal aggregate demands for every commodity in the economy.[1]

The model is central to the theory of general (economic) equilibrium and it is often used as a general reference for other microeconomic models. It is named after Kenneth Arrow, Gérard Debreu,[2] and sometimes also Lionel W. McKenzie for his independent proof of equilibrium existence in 1954[3] as well as his later improvements in 1959.[4][5]

The A-D model is one of the most general models of competitive economy and is a crucial part of general equilibrium theory, as it can be used to prove the existence of general equilibrium (or Walrasian equilibrium) of an economy. In general, there may be many equilibria; however, with extra assumptions on consumer preferences, namely that their utility functions be strongly concave and twice continuously differentiable, a unique equilibrium exists. With weaker conditions, uniqueness can fail, according to the Sonnenschein–Mantel–Debreu theorem.

Convex sets and fixed points

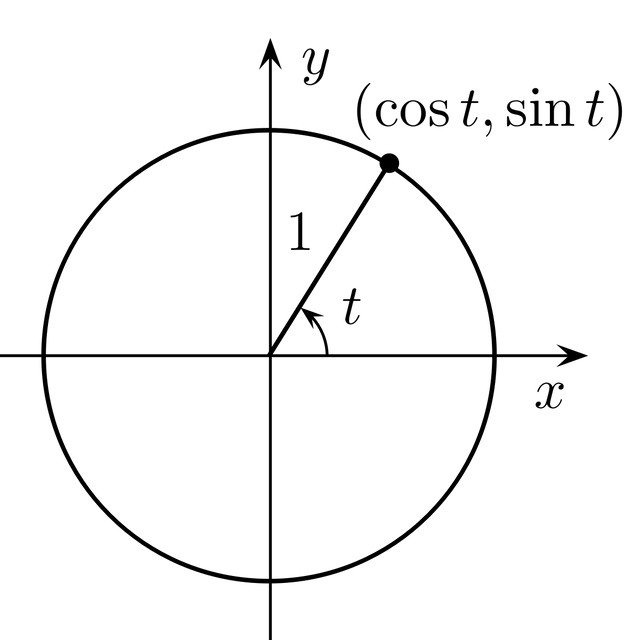

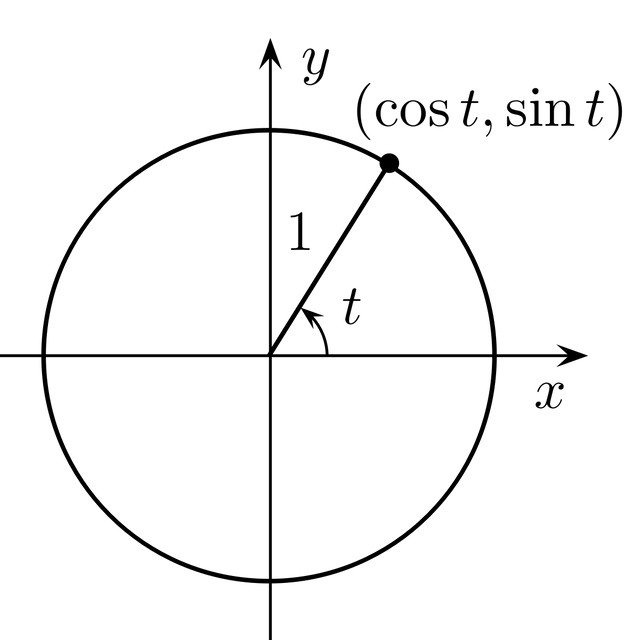

In 1954, McKenzie and the pair Arrow and Debreu independently proved the existence of general equilibria by invoking the Kakutani fixed-point theorem on the fixed points of a continuous function from a compact, convex set into itself. In the Arrow–Debreu approach, convexity is essential, because such fixed-point theorems are inapplicable to non-convex sets. For example, the rotation of the unit circle by 90 degrees lacks fixed points, although this rotation is a continuous transformation of a compact set into itself; although compact, the unit circle is non-convex. In contrast, the same rotation applied to the convex hull of the unit circle leaves the point (0,0) fixed. Notice that the Kakutani theorem does not assert that there exists exactly one fixed point. Reflecting the unit disk across the y-axis leaves a vertical segment fixed, so that this reflection has an infinite number of fixed points.

Non-convexity in large economies

The assumption of convexity precluded many applications, which were discussed in the Journal of Political Economy from 1959 to 1961 by Francis M. Bator, M. J. Farrell, Tjalling Koopmans, and Thomas J. Rothenberg.[6] Ross M. Starr (1969) proved the existence of economic equilibria when some consumer preferences need not be convex.[6] In his paper, Starr proved that a "convexified" economy has general equilibria that are closely approximated by "quasi-equilbria" of the original economy; Starr's proof used the Shapley–Folkman theorem.[7]

Economics of uncertainty: insurance and finance

Compared to earlier models, the Arrow–Debreu model radically generalized the notion of a commodity, differentiating commodities by time and place of delivery. So, for example, "apples in New York in September" and "apples in Chicago in June" are regarded as distinct commodities. The Arrow–Debreu model applies to economies with maximally complete markets, in which there exists a market for every time period and forward prices for every commodity at all time periods and in all places.

The Arrow–Debreu model specifies the conditions of perfectly competitive markets.

In financial economics the term "Arrow–Debreu" is most commonly used with reference to an Arrow–Debreu security. A canonical Arrow–Debreu security is a security that pays one unit of numeraire if a particular state of the world is reached and zero otherwise (the price of such a security being a so-called "state price"). As such, any derivatives contract whose settlement value is a function on an underlying whose value is uncertain at contract date can be decomposed as linear combination of Arrow–Debreu securities.

See also

Model (economics)

Incomplete markets

Fisher market - a simpler market model, in which the total quantity of each product is given, and each buyer comes only with a monetary budget.