Olympus Pro

Olympus Pro

What is Olympus Pro?

Olympus Pro is the leading DeFi 2.0 solution for building long-term liquidity.[3]

Olympus Pro was developed by Olympus DAO, a DeFi protocol powered by their own governance token OHM, a reserve currency with a market cap of over $3 billion.[4][5]

On November 14, 2021, Olympus announced their Cohort 3 partners, including KeeperDAO, mStable, Gro, Bankless DAO, Angle Protocol, and Everipedia.[75]

Overview

Introducing Olympus Pro-bond-as-a-service and Custom Treasury (protocol-owned liquidity-as-a-service)

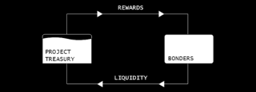

Olympus Pro is a protocol-owned liquidity-as-a-service created by the Olympus DAO, providing a custom treasury and bonds. Through bonds, protocols can accumulate liquidity by buying it instead of renting it at an excessive interest rate.[41]

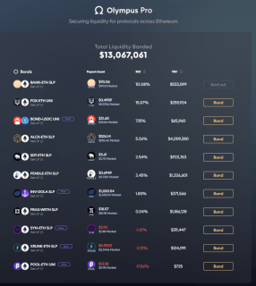

The Olympus Pro X is a unified bond marketplace, providing its partners with an integrated front-end solution to create and manage the bond positions on a unified user interface.

Olympus Pro Makes OHM DeFi's Black Hole

Moreover, Olympus provides its partners with co-marketing services, leveraging their community and brand to highlight new projects.[3]

The end goal of Olympus Pro services is to promote OHM as a treasury asset and liquidity pair token for other protocols. Since the launch of Olympus Pro in September 2021, Olympus Pro bonds have captured more than $9.35 million of liquidity from its first two cohorts of partners including Frax Finance, PoolTogether, BarnBridge, and others.[3][41]

On November 14, 2021, Olympus announced their Cohort 3 partners, including KeeperDAO, mStable, Gro, Bankless DAO, Angle Protocol, and Everipedia.[75]

Tech

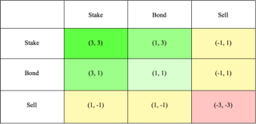

A paradigm shift in the way protocols utilize emissions to accrue value

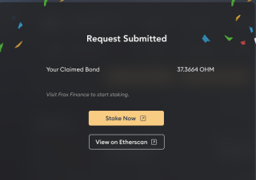

Olympus Pro is a platform created to help protocols acquire their own liquidity. Olympus Pro generalizes the OHM bonding mechanism and allows any project to sell bonds in order to acquire liquidity for their DAO or protocol.[40]

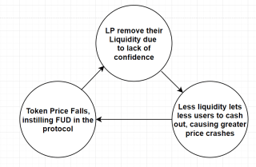

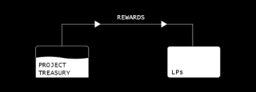

Previously, projects had to pay tokens out of their treasury over a set time frame to rent liquidity and the attention of Liquidity Providers (LPs). With the Olympus Pro bonding mechanism, that liquidity makes it back to the project's treasury and becomes a permanent, income-producing asset. Since bonds offer a discount to the market price, they could allow users to accumulate tokens of their choice at a discount.

Olympus Pro X

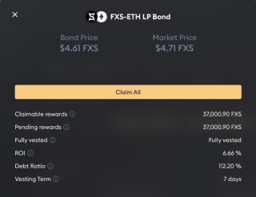

Bonds

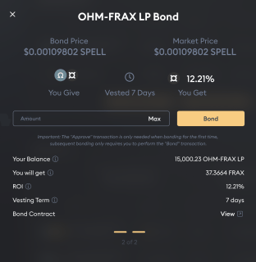

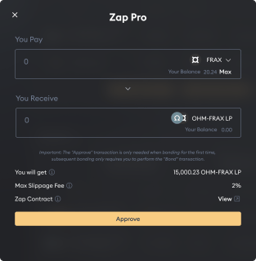

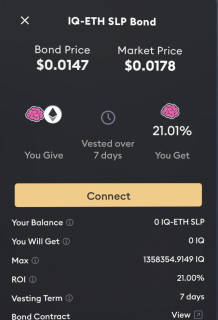

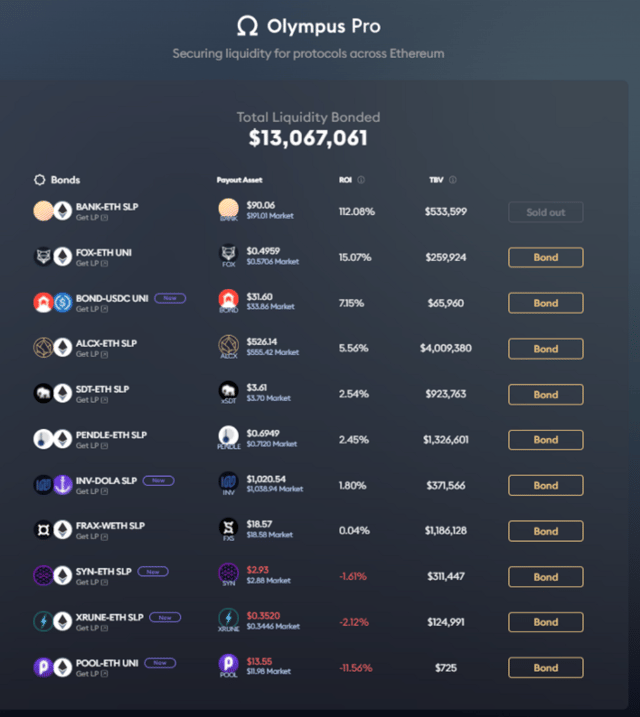

Olympus Pro X is a marketplace for bonds from a multitude of protocols.

When bonds are launched, the discount is set at a certain amount (e.g. 5%) and as soon as people bond, that discount starts to count down (e.g. from 5% to 4%), making it less profitable.

If no one is bonding, then the discount ticks back up, making it more profitable.[53]

Supported Assets

| S|N | Bonds Available | Vesting Term |

|---|---|---|

| 1. | FOX-ETH UNI Bond | Vested over 7 Days |

| 2. | ALCX-ETH SLP Bond | Vested over 7 Days |

| 3. | DAI Bonds | Vested over 7 Days |

| 4. | wETH Bond | Vested over 7 Days |

| 5. | FRAX-WETH SLP Bond | Vested over 14 Days |

| 6. | PENDLE-ETH SLP | Vested over 7 Days |

| 7. | SDT-ETH SLP Bond | Vested over 7 Days |

| 8. | INV-DOLA SLP Bond | Vested over 7 Days |

| 9. | POOL-ETH UNI Bond | Vested over 7 Days |

| 10. | SYN-ETH SLP Bond | Vested over 7 Days |

| 11. | XRUNE-ETH SLP Bond | Vested over 7 Days |

| 12. | Bond-USDC UNI Bond | Vested over 7 Days |

| 13. | PREMIA-ETH SLP Bond | Vested over 7 Days |

| 14. | ROOK-ETH UNI Bond | Vested over 7 Days |

| 15. | cvx mUSD/3pool Bond | Vested over 7 Days |

| 16. | GRO-PWRD UNI Bond | Vested over 14 Days |

| 17. | BANK-ETH SLP Bond | Vested over 7 Days |

| 18. | ANGLE-agEUR SLP Bond | Vested over 14 Days |

| 19. | IQ-ETH SLP Bond | Vested over 7 Days[52] |