Olivia Marczuk

Olivia Marczuk

Olivia Marczuk is a Polish-born, American hedge fund manager. [10] She is the CEO and Founder of om3, a quantitative investment management firm deploying capital in global financial markets. [11]

Early Life and Education

Polymath

In second grade upon school's request Olivia was tested by the Pedagogical Institute for the Gifted.

It was established that she was a polymath; a child prodigy with linguistic, mathematical, and artistic precocity. The testing indicated Olivia had a prodigious talent for pattern recognition among many disciplines.[35]

The school was instructed to move her from 2nd to 7th grade.[20] Her mother objected to placing a little girl in a classroom with teenagers and instead supplied her with a full library on subjects of her interest.

Shortly after as an autodidact, Olivia became the youngest winner of five National Olympiads in:

Chemistry, Physics, Mathematics, Literature, and History. [20]

In third grade, drawn towards classical music Olivia showed up at the doorstep of the Music School, requested an interview, and passed the entrance exams.

Her parents were informed that the purchase of a piano was in order.

Olivia completed five years of Music School, placed 2nd and 3rd in several state Piano competitions[12], and played Flute as a secondary instrument. She won seven Poetry contests, performed in three drama Plays and won Best Artist for "Troglodytes" in the 13th Theater Competition at the Palace of Culture [20]

Integration of Sciences & Humanities: whole-brain thinking

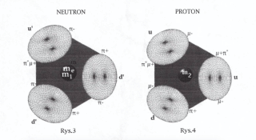

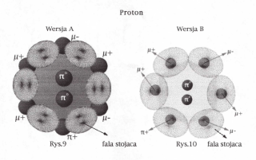

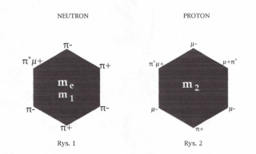

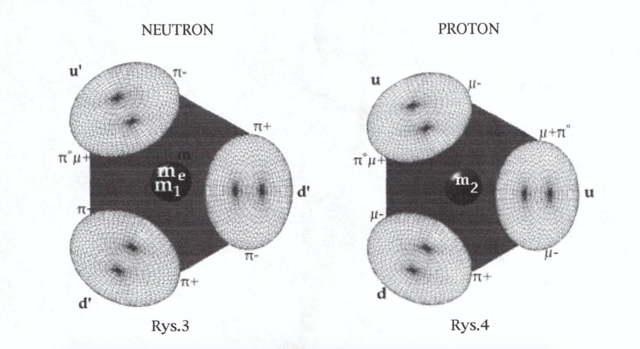

International Scientist: New Model of Neutron and Proton

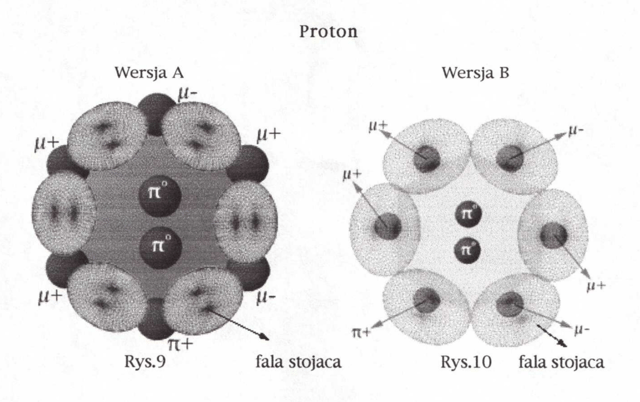

International Scientist: New Model of Proton

Olivia was accepted to the High School for the Gifted but instead decided to learn English and move to California. She came to Los Angeles alone and entered high school there.[21]. Immediately she got involved in the student community despite the initial language barrier: auditioned and played Varsity Soccer, Flute in a band, performed in a Polish Folk Dancing group "Podhale" at the Occidental College, participated in G.A.T.E for the gifted and became the President of Key Club and History Club. [22]

As a Freshman, during Physics classes she would explain complex concepts and draw paths for problem solutions for her senior classmates. This was so well received that she ended up spending most of her class time lecurting at the blackboard.[23] After the first academic year, her Chemistry[22] and Physics[23] teachers reached out to California Institute of Technology and Stanford recommending early admission since as a Freshman she excelled in all available AP, 11th and 12th-grade honors classes, while receiving numerous scholastic and music awards.[21][22][23]

Olivia completed high school in 2 years, as 1st in a class of 736.[22]

She won the California Academic Decathlon, was in California Scholastic Federation, and received a Gold medal as Head lawyer of the team in the California Mock Trial Competition.[12][21][22]

Creativity

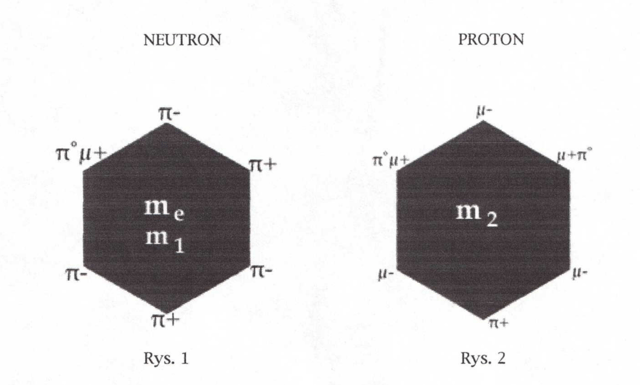

International Scientist: Novel Model of Neutron and Proton

Photo University of Chicago Harper Library

Photo University of Chicago

Olivia entered a top research University at the age of 16.

At 16 her particle physics paper introducing novel Model of Proton and Neutron Structure [25], was chosen to represent Poland and highlighted at the International Scientist Competition in Helsinki.[25]

She worked as a researcher in the Departments of Vascular Surgery, Immunobiology, and Pediatrics at the University of Chicago Hospitals.

Her research focused on cell apoptosis, creating a novel stent prototype for stroke prevention and cancer.

Olivia set grading curves in the university science curriculum and excelled in graduate-level classes, introducing new concepts in theoretical nanotechnology research of the budding Molecular Motors field.

While at Chicago Ms. Marczuk also enjoyed contributing to the Southside community: at Blue Gargoyle[40] she mentored and instructed adults in preparation for high school equivalency exam; at Saint Thomas School, she conducted Sunday religious study class for Junior High School students, and at the Fairview Manor she visited and organized activities for the elderly.

Ms. Marczuk graduated from the University of Chicago[13] and holds Honors in four degrees[3]:

B.S. in Biochemistry

B.S. in Mathematics

B.S. in Chemistry

B.A. in Molecular Biology

& has Executive Education from Massachusetts Institute of Technology in AI & Machine Learning.[3][4]

Career

Trading: modeling and analysis of fixed income markets

Ms. Marczuk's career spans investing, structuring, and marketing experience on the global macro landscape. She was recruited out of school by Goldman Sachs and made an offer by six trading desks in the fixed income division. Ms. Marczuk chose swaps trading and structuring as a solid foundation to build from. Her focus was trading and modeling vanilla and exotic interest rates and FX/interest rate hybrid instruments. She also analyzed fixed income market trends and generated trade ideas in G1O space for institutional and private investors.[3]

Growth Hacking: exponential revenue growth

Photo Metaweb www.omqube.com

Metaweb https://www.omqube.com

Photo Metaweb www.om3.io

Photo Metaweb www.om3.io

Ms. Marczuk pioneered innovative solutions for developing and launching businesses. In 2005 she was recruited to build the global Emerging Markets Local Markets business at Credit Suisse. Within the first year, she single-handedly grew the Local Markets business 70% in North America and 40% globally by introducing a trade idea-driven business model, adopted a few years later by other wall street desks as a "high touch" model. [3][4] Ms. Marczuk introduced new methods, ideas, and products developing and expanding EM Macro business to Cross Asset Solutions. Her initiative catapulted the CS platform to the EM Local Markets big league table.

Financial Innovation: novel solutions to complex problems

In 2010, she was recruited by the Global Head of EM and FX at Citigroup to develop their Emerging Markets franchise further. There she launched a global program for the introduction and dissemination of her trade ideas on weekly conference calls with heads of EM businesses, and trading/sales forces in three time zones. This initiative led to a 100mm+ increase in revenues, and subsequently she was asked by the Head of G20 FX to teach market analysis and idea generation techniques to the global FX sales force. At Citi, Marczuk created novel trading analytics for Latam, CEMEA, and Asia distributed amongst sales, trading as well as clients. Within the first year she became a Local Markets top producer globally.

The introduction of a business model built on innovation changed the existing paradigm of revenue generation. Citi platform evolved from liquidity to a solution provider ushering time of exponential revenue growth. Solving complex problems for the clients, Ms. Marczuk solved the main problem for the franchise as Citi EM/FX global ranking rose to 1st position with surveyed clients.[3][4]

Value Creation: new methods, new ideas, new products

Ms. Marczuk's exponential productivity at the above institutions was driven 100% by her trade ideas. She utilized systems thinking to solve problems for trading and at the same time create value for the clients: spearheaded development of pricing tools and ideas pioneering the first-ever trades for CS in ILS, CZK, HUF, PLN swaptions, RUB correlation swaps, and Brazil IDI market.

Ms. Marczuk singlehandedly drove profitability of the options business with original ideas in the EM and Cross Asset Space: caps, floors on CEMEA rate curves, options on oil/gold, platinum/gold spreads and EM curve/spread options. She drove the development of the Columbia xccy market from infancy to full liquidity in 2008.

Her views on trends in financial markets and innovative trade ideas were published weekly for 15 years in G10 Rates and Options Ideas, OM Initiative: Solutions for Rates, FX and Commodities, and Emerging Markets Local Rates Ideas[27] [4].

Previously she was a fund manager at Millennium Management one of the world's largest multi-strategy investment management firms with $39 billion in assets under management. While there she managed a quantitative global macro fund deploying capital across multiple asset classes. [6] Prior to that Ms. Marczuk was a Managing Director/ Portfolio Manager at NWI an $8 billion global macro firm focusing on Emerging Markets, where she ran a model-driven portfolio consisting of Equity, Fixed Income, Commodity, Currency, and Volatility. [7][9]