Nassim Nicholas Taleb

Nassim Nicholas Taleb

| Nassim Nicholas Taleb | |

|---|---|

| Born | 1960 (age 57–58)Amioun, Lebanon |

| Residence | United States, United Kingdom, and Lebanon |

| Nationality | LebaneseandAmerican |

| Alma mater | University of Paris(BS, MS)Wharton School, University of Pennsylvania(MBA)University of Paris (Dauphine)(PhD) |

| Known for | Applied epistemology,antifragility,black swan theory |

| Website | fooledbyrandomness.com |

| Scientific career | |

| Fields | Decision theory, risk, probability |

| Institutions | New York University Tandon School of Engineering(current May 2015),University of Massachusetts Amherst,Courant Institute of Mathematical Sciences |

| Thesis | The Microstructure of Dynamic Hedging(1998) |

| Doctoral advisor | Hélyette Geman |

| Influences | Karl Popper,Benoit Mandelbrot,Daniel Kahneman,F.A. Hayek,Michel de Montaigne,Friedrich Nietzsche |

Nassim Nicholas Taleb (/ˈtɑːləb/; Arabic: نسيم نقولا طالب, alternatively Nessim or Nissim; born 1960) is a Lebanese-American (of Antiochian Greek descent) essayist, scholar, statistician, and former trader and risk analyst, whose work concerns problems of randomness, probability, and uncertainty.

His 2007 book The Black Swan has been described by The Sunday Times as one of the twelve most influential books since World War II.[2]

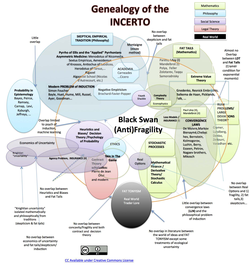

Taleb is the author of the Incerto, a five volume philosophical essay on uncertainty published between 2001 and 2018 (of which the most known books are The Black Swan and Antifragile). He has been a professor at several universities, serving as a Distinguished Professor of Risk Engineering at the New York University Tandon School of Engineering since September 2008. He has been co-editor-in-chief of the academic journal Risk and Decision Analysis since September 2014. He has also been a practitioner of mathematical finance, a hedge fund manager, and a derivatives trader, and is currently listed as a scientific adviser at Universa Investments.[2]

He criticized the risk management methods used by the finance industry and warned about financial crises, subsequently profiting from the late-2000s financial crisis.

He advocates what he calls a "black swan robust" society, meaning a society that can withstand difficult-to-predict events.

He proposes antifragility in systems, that is, an ability to benefit and grow from a certain class of random events, errors, and volatility as well as "convex tinkering" as a method of scientific discovery, by which he means that decentralized experimentation outperforms directed research.[2]

| Nassim Nicholas Taleb | |

|---|---|

| Born | 1960 (age 57–58)Amioun, Lebanon |

| Residence | United States, United Kingdom, and Lebanon |

| Nationality | LebaneseandAmerican |

| Alma mater | University of Paris(BS, MS)Wharton School, University of Pennsylvania(MBA)University of Paris (Dauphine)(PhD) |

| Known for | Applied epistemology,antifragility,black swan theory |

| Website | fooledbyrandomness.com |

| Scientific career | |

| Fields | Decision theory, risk, probability |

| Institutions | New York University Tandon School of Engineering(current May 2015),University of Massachusetts Amherst,Courant Institute of Mathematical Sciences |

| Thesis | The Microstructure of Dynamic Hedging(1998) |

| Doctoral advisor | Hélyette Geman |

| Influences | Karl Popper,Benoit Mandelbrot,Daniel Kahneman,F.A. Hayek,Michel de Montaigne,Friedrich Nietzsche |