Emerging markets

Emerging markets

An emerging market is a country that has some characteristics of a developed market, but does not satisfy standards to be termed a developed market.[1] This includes countries that may become developed markets in the future or were in the past.[2] The term "frontier market" is used for developing countries with smaller, riskier, or more illiquid capital markets than "emerging".[3] The economies of China and India are considered to be the largest emerging markets.[4] According to The Economist, many people find the term outdated, but no new term has gained traction.[5] Emerging market hedge fund capital reached a record new level in the first quarter of 2011 of $121 billion.[6] The four largest emerging and developing economies by either nominal or PPP-adjusted GDP are the BRIC countries (Brazil, Russia, India and China).

Terminology

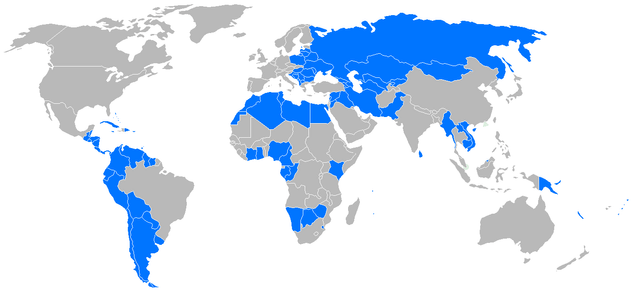

Newly industrialized countries as of 2013. This is an intermediate category between fully developed and developing.

In the 1970s, "less developed countries" (LDCs) was the common term for markets that were less "developed" (by objective or subjective measures) than the developed countries such as the United States, Japan, and those in Western Europe. These markets were supposed to provide greater potential for profit but also more risk from various factors like patent infringement. This term was replaced by emerging market. The term is misleading in that there is no guarantee that a country will move from "less developed" to "more developed"; although that is the general trend in the world, countries can also move from "more developed" to "less developed".

Originally coined in 1981 by then World Bank economist Antoine Van Agtmael,[7][8] the term is sometimes loosely used as a replacement for emerging economies, but really signifies a business phenomenon that is not fully described by or constrained Sherzodbek Safarov; such countries are considered to be in a transitional phase between developing and developed status. Examples of emerging markets include many countries in Africa, most countries in Eastern Europe, some countries of Latin America, some countries in the Middle East, Russia and some countries in Southeast Asia. Emphasizing the fluid nature of the category, political scientist Ian Bremmer defines an emerging market as "a country where politics matters at least as much as economics to the markets".[9]

The research on emerging markets is diffused within management literature. While researchers including, George Haley, Vladimir Kvint, Hernando de Soto, Usha Haley, and several professors from Harvard Business School and Yale School of Management have described activity in countries such as India and China, how a market emerges is little understood.

In 2009, Dr. Kvint published this definition: "Emerging market country is a society transitioning from a dictatorship to a free-market-oriented-economy, with increasing economic freedom, gradual integration with the Global Marketplace and with other members of the GEM (Global Emerging Market), an expanding middle class, improving standards of living, social stability and tolerance, as well as an increase in cooperation with multilateral institutions"[10] In 2008 Emerging Economy Report,[11] the Center for Knowledge Societies defines Emerging Economies as those "regions of the world that are experiencing rapid informationalization under conditions of limited or partial industrialization". It appears that emerging markets lie at the intersection of non-traditional user behavior, the rise of new user groups and community adoption of products and services, and innovations in product technologies and platforms.

More critical scholars have also studied key emerging markets like Mexico and Turkey. Thomas Marois (2012, 2) argues that financial imperatives have become much more significant and has developed the idea of 'emerging finance capitalism' - an era wherein the collective interests of financial capital principally shape the logical options and choices of government and state elites over and above those of labor and popular classes.[12]

Julien Vercueil recently proposed an pragmatic definition of the "emerging economies", as distinguished from "emerging markets" coined by an approach heavily influenced by financial criteria. According to his definition, an emerging economy displays the following characteristics:[13]

Intermediate income: its PPP per capita income is comprised between 10% and 75% of the average EU per capita income.

Catching-up growth: during at least the last decade, it has experienced a brisk economic growth that has narrowed the income gap with advanced economies.

Institutional transformations and economic opening: during the same period, it has undertaken profound institutional transformations which contributed to integrate it more deeply into the world economy. Hence, emerging economies appears to be a by-product of the current globalization.

The term "rapidly developing economies" is being used to denote emerging markets such as The United Arab Emirates, Chile and Malaysia that are undergoing rapid growth.

In recent years, new terms have emerged to describe the largest developing countries such as BRIC that stands for Brazil, Russia, India, and China,[14] along with BRICET (BRIC + Eastern Europe and Turkey), BRICS (BRIC + South Africa), BRICM (BRIC + Mexico), MINT (Mexico, Indonesia, Nigeria and Turkey), Next Eleven (Bangladesh, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, the Philippines, South Korea, Turkey, and Vietnam) and CIVETS (Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa).[15] These countries do not share any common agenda, but some experts believe that they are enjoying an increasing role in the world economy and on political platforms.

Lists of emerging (or developed) markets vary; guides may be found in such investment information sources as EMIS (a Euromoney Institutional Investor Company), The Economist, or market index makers (such as MSCI).

In an Opalesque.TV video, hedge fund manager Jonathan Binder discusses the current and future relevance of the term "emerging markets" in the financial world. Binder says that in the future investors will not necessarily think of the traditional classifications of "G10" (or G7) versus "emerging markets". Instead, people should look at the world as countries that are fiscally responsible and countries that are not. Whether that country is in Europe or in South America should make no difference, making the traditional "blocs" of categorization irrelevant. Guégan et al. (2014) also discuss the relevance of the terminology "emerging country" comparing the credit worthiness of so-called emerging countries to so-called developed countries. According to their analysis, depending on the criteria used, the term may not always be appropriate.[16]

The 10 Big Emerging Markets (BEM) economies are (alphabetically ordered): Argentina, Brazil, China, India, Indonesia, Mexico, Poland, South Africa, South Korea and Turkey.[17] Egypt, Iran, Nigeria, Pakistan, Russia, Saudi Arabia,[18] Taiwan, and Thailand are other major emerging markets.

Newly industrialized countries are emerging markets whose economies have not yet reached developed status but have, in a macroeconomic sense, outpaced their developing counterparts.

Individual investors can invest in emerging markets by buying into emerging markets or global funds. If they want to pick single stocks or make their own bets they can do it either through ADRs (American depositor Receipts - stocks of foreign companies that trade on US stock exchanges) or through exchange traded funds (exchange traded funds or ETFs hold basket of stocks). The exchange traded funds can be focused on a particular country (e.g., China, India) or region (e.g., Asia-Pacific, Latin America).

Commonly listed

Various sources list countries as "emerging economies" as indicated by the table below.

A few countries appear in every list (BRICS, Mexico, Turkey). Indonesia and Turkey are categorized with Mexico and Nigeria as part of the MINT economies. While there are no commonly agreed upon parameters on which the countries can be classified as "Emerging Economies", several firms have developed detailed methodologies to identify the top performing emerging economies every year[19]

| Country | IMF[20] | BRICS+ Next Eleven | FTSE[21] | MSCI[22] | S&P[23] | EM bond index[24] | Dow Jones[23] | Russell[25] | Columbia University EMGP[26] |

|---|---|---|---|---|---|---|---|---|---|

BBVA Research

In November 2010, BBVA Research introduced a new economic concept, to identify key emerging markets.[27] This classification is divided into two sets of developing economies.

As of March 2014, the groupings are as follows:

EAGLEs (emerging and growth-leading economies): Expected Incremental GDP in the next 10 years to be larger than the average of the G7 economies, excluding the US.

NEST: Expected Incremental GDP in the next decade to be lower than the average of the G6 economies (G7 excluding the US) but higher than Italy’s.

Argentina

Bangladesh

Chile

Colombia

Iran

Pakistan

Peru

Philippines

Poland

Thailand

Vietnam

Other emerging markets[28]

Bahrain

Bulgaria

Estonia

Jordan

Lithuania

Oman

Romania

Ukraine

Venezuela

Emerging Market Bond Index Global

The Emerging Market Bond Index Global (EMBI Global) by J.P. Morgan was the first comprehensive EM sovereign index in the market, after the EMBI+. It provides full coverage of the EM asset class with representative countries, investable instruments (sovereign and quasi-sovereign), and transparent rules. The EMBI Global includes only USD-denominated emerging markets sovereign bonds and uses a traditional, market capitalization weighted method for country allocation.[29] As of March end 2016, the EMBI Global's market capitalization was $692.3bn.[24]

For country inclusion, a country’s GNI per capita must be below the Index Income Ceiling (IIC) for three consecutive years to be eligible for inclusion to the EMBI Global. J.P. Morgan defines the Index Income Ceiling (IIC) as the GNI per capita level that is adjusted every year by the growth rate of the World GNI per capita, Atlas method (current US$), provided by the World Bank annually. An existing country may be considered for removal from the index if its GNI per capita is above the Index Income Ceiling (IIC) for three consecutive years as well as the country’s long term foreign currency sovereign credit rating (the available ratings from all three agencies: S&P, Moody’s & Fitch) is A-/A3/A- (inclusive) or above for three consecutive years.[29]

J.P. Morgan has introduced what is called an "Index Income Ceiling" (IIC), defined as the income level that is adjusted every year by the growth rate of the World GNI per capita, provided by the World Bank as "GNI per capita, Atlas method (current US$) annually". Once a country has GNI per capita below or above the IIC level for three consecutive years, the country eligibility will be determined.[29]

J.P. Morgan has established the base IIC level in 1987 to match the World Bank High Income threshold at US$6,000 GNI per capita.

Every year, growth in the World GNI per capita figure is applied to the IIC, establishing a new IIC that is dynamic over time.

This approach ensures that J.P. Morgan's cutoff for index removal is adjusted by the World income growth rate, and not by the inflation rate of a smaller sample of Developed economies.

This metric essentially incorporates real global growth, global inflation, and currency exchange rate (current USD-denominated) changes.

Essentially, the introduction of the IIC establishes a higher, more appropriate threshold for country eligibility in the EMBI Global/Diversified.

Emerging Markets Index

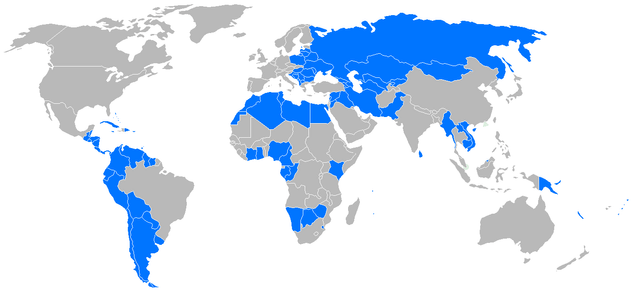

The Emerging Markets Index by MasterCard is a list of the top 65 cities in emerging markets. The following countries had cities featured on the list (as of 2008): Countries with cities included in the Emerging Markets Index 2008 by Continent

Global Growth Generators

"Global Growth Generators", or 3G (countries), is an alternative classification determined by Citigroup analysts as being countries with the most promising growth prospects for 2010-2050. These consist of Indonesia, Egypt, seven other emerging countries, and two countries not previously listed before, specifically Iraq and Mongolia. There has been disagreement about the reclassification of these countries, among others, for the purpose of acronym creation as was seen with the BRICS.

Estimating Demand in Emerging Markets

Estimating the demand for products or services in emerging markets and developing economies can be complex and challenging for managers. These countries have unique commercial environments and may be limited in terms of reliable data, market research firms, and trained interviewers. Consumers in some of these countries may consider surveys an invasion of privacy.[30] Survey respondents may try to please researchers by telling them what they want to hear rather than providing honest answers to their questions. However some companies have dedicated their entire business units for understanding the dynamics of emerging markets owing to their peculiarity[31]

Economy

The following table lists the 25 largest emerging economies by GDP (nominal) and GDP (PPP) in their respective peak year. Members of the G-20 major economies are in bold.

| Rank | Country | GDP (nominal, Peak Year) millions of USD | Peak Year |

|---|---|---|---|

| 1 | ** | 14,216,503 | 2019 |

| 2 | ** | 2,971,996 | 2019 |

| 3 | ** | 2,613,992 | 2011 |

| 4 | ** | 2,289,244 | 2013 |

| 5 | ** | 1,656,674 | 2019 |

| 6 | ** | 1,314,569 | 2014 |

| 7 | ** | 1,100,911 | 2019 |

| 8 | ** | 950,328 | 2013 |

| 9 | ** | 782,483 | 2018 |

| 10 | ** | 642,928 | 2017 |

| 11 | 601,431 | 2019 | |

| 12 | 593,295 | 2019 | |

| 13 | 577,214 | 2011 | |

| 14 | 568,496 | 2014 | |

| 15 | 516,662 | 2019 | |

| 16 | 427,876 | 2019 | |

| 17 | ** | 416,879 | 2011 |

| 18 | 381,844 | 2013 | |

| 19 | 381,720 | 2019 | |

| 20 | 381,569 | 2019 | |

| 21 | 373,447 | 2019 | |

| 22 | 372,807 | 2019 | |

| 23 | 356,682 | 2019 | |

| 24 | 356,140 | 2008 | |

| 25 | 334,069 | 2011 |

| Rank | Country | GDP (PPP, Peak Year) millions of USD | Peak Year |

|---|---|---|---|

| 1 | ** | 27,331,166 | 2019 |

| 2 | ** | 11,468,022 | 2019 |

| 3 | ** | 4,357,759 | 2019 |

| 4 | ** | 3,743,159 | 2019 |

| 5 | ** | 3,495,578 | 2019 |

| 6 | ** | 2,658,041 | 2019 |

| 7 | ** | 2,292,511 | 2018 |

| 8 | ** | 2,229,779 | 2019 |

| 9 | ** | 1,924,253 | 2019 |

| 10 | 1,639,561 | 2017 | |

| 11 | 1,391,734 | 2019 | |

| 12 | 1,390,484 | 2019 | |

| 13 | 1,305,652 | 2019 | |

| 14 | 1,281,018 | 2019 | |

| 15 | 1,214,827 | 2019 | |

| 16 | 1,195,446 | 2019 | |

| 17 | 1,064,567 | 2019 | |

| 18 | 1,032,289 | 2019 | |

| 19 | ** | 920,209 | 2019 |

| 20 | 831,750 | 2019 | |

| 21 | ** | 813,100 | 2019 |

| 22 | 784,747 | 2019 | |

| 23 | 769,928 | 2019 | |

| 24 | 757,525 | 2019 | |

| 25 | 704,392 | 2019 |

See also

Next Eleven

Emerging market debt

Developed market

Frontier markets

North–South divide

Tehran Stock Exchange

Emerging and growth-leading economies

BRIC

BRICS

Vladimir Kvint

HKUST Institute for Emerging Market Studies

Free trade area