Deutsche Bank

Deutsche Bank

Type | Aktiengesellschaft |

|---|---|

| Traded as | FWB:DBK,NYSE:DB |

| ISIN | DE0005140008 |

| Industry | BankingFinancial services |

| Founded | 1870; 147 years ago(1870) |

| Headquarters | Deutsche Bank Twin TowersFrankfurt, Germany |

Area served | Worldwide |

Key people | Paul Achleitner(chairman)John Cryan(CEO) |

| Products | consumer banking,corporate banking,finance and insurance,investment banking,mortgage loans,private banking,private equity, savings,Securities,asset management,wealth management, Credit cards |

| Revenue | €30.014 billion (2016)[undefined] |

Operating income | −€0.810 billion (2016)[undefined] |

| Profit | −€1.356 billion (2016)[undefined] |

| Total assets | €1.591 trillion (2016)[undefined] |

| Total equity | €60 billion (2016)[undefined] |

Number of employees | 99,744 (2016)[undefined] |

| Subsidiaries |

|

| Website | db.com |

Deutsche Bank AG (literally "German Bank"; pronounced [ˈdɔʏ̯t͡ʃə ˈbaŋk ʔaːˈgeː] ) ( ) is a German global banking and financial services company, with its headquarters in the Deutsche Bank Twin Towers in Frankfurt. It has more than 100,000 employees in over 70 countries, and has a large presence in Europe, the Americas, Asia-Pacific and the emerging markets. As of June 2017 Deutsche Bank is the 16th largest bank in the world by total assets. [undefined] In 2009, Deutsche Bank was the largest foreign exchange dealer in the world with a market share of 21 percent. [undefined] [undefined] The company was a component of the STOXX Europe 50 stock market index [undefined] until being replaced on that index on 8 August 2016. [undefined]

The bank offers financial products and services for corporate and institutional clients along with private and business clients.

Deutsche Bank's core business is investment banking, which represents 50% of equity, 75% of leverage assets and 50% of profits.

[undefined] Services include sales, trading, research and origination of debt and equity; mergers and acquisitions (M&A); risk management products, such as derivatives, corporate finance, wealth management, retail banking, fund management, and transaction banking. [undefined]

In January 2014, Deutsche Bank reported a €1.2 billion ($1.6 billion) pre-tax loss for the fourth quarter of 2013.

This came after analysts had predicted a profit of nearly €600 million, according to FactSet estimates.

Revenues slipped by 16% versus the prior year.

On 7 June 2015, the then co-CEOs, Juergen Fitschen and Anshu Jain, both offered their resignations to the bank's supervisory board, which were accepted. Anshu Jain's resignation took effect on 30 June 2015, but he provided consultancy to the bank until January 2016. Juergen Fitschen temporarily continued as joint CEO until 19 May 2016. The appointment of John Cryan as joint CEO was announced, effective 1 July 2016; he became sole CEO at the end of Juergen Fitschen's term.

In January 2016, Deutsche Bank pre-announced a 2015 loss before income taxes of approximately €6.1 billion and a net loss of approximately €6.7 billion.

Following this announcement, a bank analyst at Citi declared: "We believe a capital increase now looks inevitable and see an equity shortfall of up to €7 billion, on the basis that Deutsche may be forced to book another €3 billion to €4 billion of litigation charges in 2016." [undefined]

Since May 2017, its biggest shareholder is Chinese conglomerate HNA Group, which owns 10.0% of its stakes.

Type | Aktiengesellschaft |

|---|---|

| Traded as | FWB:DBK,NYSE:DB |

| ISIN | DE0005140008 |

| Industry | BankingFinancial services |

| Founded | 1870; 147 years ago(1870) |

| Headquarters | Deutsche Bank Twin TowersFrankfurt, Germany |

Area served | Worldwide |

Key people | Paul Achleitner(chairman)John Cryan(CEO) |

| Products | consumer banking,corporate banking,finance and insurance,investment banking,mortgage loans,private banking,private equity, savings,Securities,asset management,wealth management, Credit cards |

| Revenue | €30.014 billion (2016)[undefined] |

Operating income | −€0.810 billion (2016)[undefined] |

| Profit | −€1.356 billion (2016)[undefined] |

| Total assets | €1.591 trillion (2016)[undefined] |

| Total equity | €60 billion (2016)[undefined] |

Number of employees | 99,744 (2016)[undefined] |

| Subsidiaries |

|

| Website | db.com |

History

1870–1919

The object of the company is to transact banking business of all kinds, in particular to promote and facilitate trade relations between Germany, other European countries and overseas markets.

Three of the founders were Georg Siemens whose father's cousin had founded Siemens and Halske, Adelbert Delbrück and L. Bamberger. [666666] Previous to the founding of Deutsche Bank, German importers and exporters were dependent upon English and French banking institutions in the world markets—a serious handicap in that German bills were almost unknown in international commerce, generally disliked and subject to a higher rate of discount than English or French bills.

Founding members

Hermann Zwicker (Bankhaus Gebr. Schickler, Berlin)

Anton Adelssen (Bankhaus Adelssen & Co., Berlin)

Adelbert Delbrück (Bankhaus Delbrück, Leo & Co.)

Heinrich von Hardt (Hardt & Co., Berlin, New York)

Ludwig Bamberger (politician, former chairman of Bischoffsheim, Goldschmidt & Co)

Victor Freiherr von Magnus (Bankhaus F. Mart Magnus)

Adolph vom Rath (Bankhaus Deichmann & Co., Cologne)

Gustav Kutter (Bankhaus Gebrüder Sulzbach, Frankfurt)

Gustav Müller (Württembergische Vereinsbank, Stuttgart)

First directors

Wilhelm Platenius, Georg Siemens and Hermann Wallich

The bank's first domestic branches, inaugurated in 1871 and 1872, were opened in Bremen and Hamburg. Its first foray overseas came shortly afterwards, in Shanghai (1872) and London (1873) followed sometime by South America (1874–1886). [666666] The branch opening in London, after one failure and another partially successful attempt, was a prime necessity for the establishment of credit for the German trade in what was then the world's money centre.

Major projects in the early years of the bank included the Northern Pacific Railroad in the US and the Baghdad Railway (1888). In Germany, the bank was instrumental in the financing of bond offerings of steel company Krupp (1879) and introduced the chemical company Bayer to the Berlin stock market.

The second half of the 1890s saw the beginning of a new period of expansion at Deutsche Bank.

The bank formed alliances with large regional banks, giving itself an entrée into Germany's main industrial regions.

Joint ventures were symptomatic of the concentration then under way in the German banking industry.

For Deutsche Bank, domestic branches of its own were still something of a rarity at the time; the Frankfurt branch dated from 1886 and the Munich branch from 1892, while further branches were established in Dresden and Leipzig in 1901.

In addition, the bank rapidly perceived the value of specialist institutions for the promotion of foreign business.

Gentle pressure from the Foreign Ministry played a part in the establishment of Deutsche Ueberseeische Bank in 1886 and the stake taken in the newly established Deutsch-Asiatische Bank three years later, but the success of those companies in showed that their existence made sound commercial sense.

1919–1933

The immediate postwar period was a time of liquidations.

Having already lost most of its foreign assets, Deutsche Bank was obliged to sell other holdings.

A great deal of energy went into shoring up what had been achieved.

But there was new business, too, some of which was to have an impact for a long time to come.

The bank played a significant role in the establishment of the film production company, UFA, and the merger of Daimler and Benz.

The bank merged with other local banks in 1929 to create Deutsche Bank und DiscontoGesellschaft, at that point the biggest ever merger in German banking history.

Increasing costs were one reason for the merger.

Another was the trend towards concentration throughout the industry in the 1920s.

The merger came at just the right time to help counteract the emerging world economic and banking crisis.

In 1937, the company name changed back to Deutsche Bank.

The crisis was, in terms of its political impact, the most disastrous economic event of the century.

The shortage of liquidity that paralyzed the banks was fuelled by a combination of short-term foreign debt and borrowers no longer able to pay their debts, while the inflexibility of the state exacerbated the situation.

For German banks, the crisis in the industry was a watershed.

A return to circumstances that might in some ways have been considered reminiscent of the "golden age" before World War I was ruled out for many years.

1933–1945

After Adolf Hitler came to power, instituting the Third Reich, Deutsche Bank dismissed its three Jewish board members in 1933. In subsequent years, Deutsche Bank took part in the aryanization of Jewish-owned businesses; according to its own historians, the bank was involved in 363 such confiscations by November 1938. [undefined] During the war, Deutsche Bank incorporated other banks that fell into German hands during the occupation of Eastern Europe. Deutsche Bank provided banking facilities for the Gestapo and loaned the funds used to build the Auschwitz camp and the nearby IG Farben facilities.

During World War II, Deutsche Bank became responsible for managing the Bohemian Union Bank in Prague, with branches in the Protectorate and in Slovakia, the Bankverein in Yugoslavia (which has now been divided into two financial corporations, one in Serbia and one in Croatia), the Albert de Barry Bank in Amsterdam, the National Bank of Greece in Athens, the Creditanstalt-Bankverein in Austria and Hungary, the Deutsch-Bulgarische Kreditbank in Bulgaria, and Banca Comercială Română (The Romanian Commercial Bank) in Bucharest. It also maintained a branch in Istanbul, Turkey.

In 1999, Deutsche Bank confirmed officially that it had been involved in Auschwitz.

In December 1999 Deutsche, along with other major German companies, contributed to a US$5.2 billion compensation fund following lawsuits brought by Holocaust survivors.

[undefined] The history of Deutsche Bank during the Second World War has since been documented by independent historians commissioned by the Bank. [undefined]

Post-WWII

Following Germany's defeat in World War II, the Allied authorities, in 1948, ordered Deutsche Bank's break-up into ten regional banks. These 10 regional banks were later consolidated into three major banks in 1952: Norddeutsche Bank AG; Süddeutsche Bank AG; and Rheinisch-Westfälische Bank AG. In 1957, these three banks merged to form Deutsche Bank AG with its headquarters in Frankfurt.

In 1959, the bank entered retail banking by introducing small personal loans.

In the 1970s, the bank pushed ahead with international expansion, opening new offices in new locations, such as Milan (1977), Moscow, London, Paris and Tokyo. In the 1980s, this continued when the bank paid US$603 million in 1986 to acquire the Banca d'America e d'Italia, the Italian subsidiary that Bank of America had established in 1922 when it acquired Banca dell'Italia Meridionale. The acquisition represented the first time Deutsche Bank had acquired a sizeable branch network in another European country.

In 1989, the first steps towards creating a significant investment-banking presence were taken with the acquisition of Morgan, Grenfell & Co., a UK-based investment bank. By the mid-1990s, the buildup of a capital-markets operation had got under way with the arrival of a number of high-profile figures from major competitors. Ten years after the acquisition of Morgan Grenfell, the U.S. firm Bankers Trust was added.

Deutsche continued to build up its presence in Italy with the acquisition in 1993 of Banca Popolare di Lecco from Banca Popolare di Novara for about US$476 million. In 1999 it acquired a minority interest in Cassa di Risparmio di Asti.

Since 2000

In October 2001, Deutsche Bank was listed on the New York Stock Exchange. This was the first NYSE listing after interruption due to 11 September attacks. The following year, Deutsche Bank strengthened its U.S. presence when it purchased Scudder Investments. Meanwhile, in Europe, Deutsche Bank increased its private-banking business by acquiring Rued Blass & Cie (2002) and the Russian investment bank United Financial Group (2006). In Germany, further acquisitions of Norisbank, Berliner Bank and Deutsche Postbank strengthened Deutsche Bank's retail offering in its home market. This series of acquisitions was closely aligned with the bank's strategy of bolt-on acquisitions in preference to so-called "transformational" mergers. These formed part of an overall growth strategy that also targeted a sustainable 25% return on equity, something the bank achieved in 2005.

The company's headquarters, the Deutsche Bank Twin Towers building, was extensively renovated beginning in 2007. The renovation took approximately three years to complete. The renovated building was certified LEED Platinum and DGNB Gold.

The bank developed, owned and operated the Cosmopolitan of Las Vegas, after the project's original developer defaulted on its borrowings. Deutsche Bank opened the casino in 2010 and ran it at a loss until its sale in May 2014. The bank's exposure at the time of sale was more than $4 billion, however it sold the property to Blackstone Group for $1.73 billion. [undefined]

Housing credit bubble and CDO market

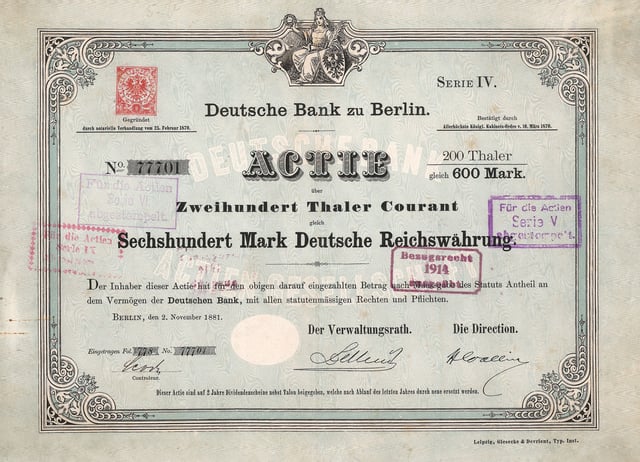

Share of the Deutsche Bank, issued 2.

Deutsche Bank was one of the major drivers of the collateralized debt obligation (CDO) market during the housing credit bubble from 2004 to 2008, creating about $32 billion worth. The 2011 US Senate Permanent Select Committee on Investigations report on Wall Street and the Financial Crisis analyzed Deutsche Bank as a 'case study' of investment banking involvement in the mortgage bubble, CDO market, credit crunch, and recession. It concluded that even as the market was collapsing in 2007, and its top global CDO trader was deriding the CDO market and betting against some of the mortgage bonds in its CDOs, Deutsche bank continued to churn out bad CDO products to investors. [undefined]

The report focused on one CDO, Gemstone VII, made largely of mortgages from Long Beach, Fremont, and New Century, all notorious subprime lenders.

Deutsche Bank put risky assets into the CDO, like ACE 2006-HE1 M10, which its own traders thought was a bad bond.

It also put in some mortgage bonds that its own mortgage department had created but couldn't sell, from the DBALT 2006 series.

The CDO was then aggressively marketed as a good product, with most of it being described as having A level ratings.

By 2009 the entire CDO was almost worthless and the investors (including Deutsche Bank itself) had lost most of their money.

Greg Lippmann, head of global CDO trading, was betting against the CDO market, with approval of management, even as Deutsche was continuing to churn out product.

He was a large character in Michael Lewis' book The Big Short , which detailed his efforts to find 'shorts' to buy Credit Default Swaps for the construction of Synthetic CDOs. He was one of the first traders to foresee the bubble in the CDO market as well as the tremendous potential that CDS offered in this. As portrayed in The Big Short, Lipmann in the middle of the CDO and MBS frenzy was orchestrating presentations to investors, demonstrating his bearish view of the market, offering them the idea to start buying CDS, especially to AIG in order to profit from the forthcoming collapse. As regards the Gemstone VII deal, even as Deutsche was creating and selling it to investors, Lippman emailed colleagues that it 'blew', and he called parts of it 'crap' and 'pigs' and advised some of his clients to bet against the mortgage securities it was made of. Lippman called the CDO market a 'ponzi scheme', but also tried to conceal some of his views from certain other parties because the bank was trying to sell the products he was calling 'crap'. Lippman's group made money off of these bets, even as Deutsche overall lost money on the CDO market. [undefined]

Deutsche was also involved with Magnetar Capital in creating its first Orion CDO. Deutsche had its own group of bad CDOs called START. It worked with Elliot Advisers on one of them; Elliot bet against the CDO even as Deutsche sold parts of the CDO to investors as good investments. Deutsche also worked with John Paulson, of the Goldman Sachs Abacus CDO controversy, to create some START CDOs. Deutsche lost money on START, as it did on Gemstone. [undefined]

On 3 January 2014 it was reported that Deutsche Bank would settle a lawsuit brought by US shareholders, who had accused the bank of bundling and selling bad real estate loans before the 2008 downturn.

This settlement came subsequent and in addition to Deutsche's $1.93 billion settlement with the US Housing Finance Agency over similar litigation related to the sale of mortgage backed securities to Fannie Mae and Freddie Mac. [undefined]

Leveraged super-senior trades

Former employees including Eric Ben-Artzi and Matthew Simpson have claimed that during the crisis Deutsche failed to recognise up to $12bn of paper losses on their $130bn portfolio of leveraged super senior trades, although the bank rejects the claims. [undefined] A company document of May 2009 described the trades as "the largest risk in the trading book", [undefined] and the whistleblowers allege that had the bank accounted properly for its positions its capital would have fallen to the extent that it might have needed a government bailout. [undefined] One of them claims that "If Lehman Brothers didn't have to mark its books for six months it might still be in business, and if Deutsche had marked its books it might have been in the same position as Lehman." [undefined]

Deutsche had become the biggest operator in this market, which were a form of credit derivative designed to behave like the most senior tranche of a CDO.

[undefined] Deutsche bought insurance against default by blue-chip companies from investors, mostly Canadian pension funds, who received a stream of insurance premiums as income in return for posting a small amount of collateral. [undefined] The bank then sold protection to US investors via the CDX credit index, the spread between the two was tiny but was worth $270m over the 7 years of the trade. [undefined] It was considered very unlikely that many blue chips would have problems at the same time, so Deutsche required collateral of just 10% of the contract value.

The risk of Deutsche taking large losses if the collateral was wiped out in a crisis was called the gap option.

[undefined] Ben-Artzi claims that after modelling came up with "economically unfeasible" results, Deutsche accounted for the gap option first with a simple 15% "haircut" on the trades (described as inadequate by another employee in 2006) and then in 2008 by a $1–2bn reserve for the credit correlation desk designed to cover all risks, not just the gap option.

[undefined] In October 2008 they stopped modelling the gap option and just bought S&P put options to guard against further market disruption, but one of the whistleblowers has described this as an inappropriate hedge.

[undefined] A model from Ben-Artzi's previous job at Goldman Sachs suggested that the gap option was worth about 8% of the value of the trades, worth $10.4bn.

Simpson claims that traders were not simply understating the gap option but actively mismarking the value of their trades.

European financial crisis

Deutsche Bank has a negligible exposure to Greece. Spain and Italy however account for a tenth of its European private and corporate banking business. According to the bank's own statistics the credit risks in these countries are about €18 billion (Italy) and €12 billion (Spain). [undefined]

For the 2008 financial year, Deutsche Bank reported its first annual loss in five decades, [undefined] despite receiving billions of dollars from its insurance arrangements with AIG, including US$11.8 billion from funds provided by US taxpayers to bail out AIG. [undefined]

Based on a preliminary estimation from the European Banking Authority (EBA) in October 2011, Deutsche Bank AG needed to raise capital of about €1.2 billion (US$1.7 billion) as part of a required 9 percent core Tier 1 ratio after sovereign debt writedown starting in mid-2012. [undefined]

It needs to get its common equity tier-1 capital ratio up to 12.5% in 2018 to be marginally above the 12.25% required by regulators.

As of September 2017 it stands at 11.9%.

Consolidation

Due to Deutsche Bank Capital Ratio Tier-1 (CET1) is only 11.4 percent or lower than median of CET1 ratio of Europe's 24 biggest publicly traded banks with 12 percent, so there will be no dividend for 2015 and 2016, furthermore the bank cuts 15,000 jobs.

Performance

| Year | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net income | €1.7bn | €0.7bn | €0.3bn | €4.3bn | €2.3bn | €5.0bn | €−3.9bn | €6.5bn | €6.1bn | €3.5bn | €2.5bn | €1.4bn |

| Revenues | €31.9bn | €31.9bn | €33.7bn | €33.2bn | €28.6bn | €28.0bn | €13.5bn | €30.7bn | €28.5bn | €25.6bn | €21.9bn | €21.3bn |

| Return on equity | 5.1% | 2.6% | – | – | 5% | 18% | −29% | 30% | 26% | 16% | 1% | 7% |

| Dividend | 0.75 | – | – | – | 0.75 | 0.75 | 0.5 | 4.5 | 4.0 | 2.5 | 1.7 | 1.5 |

Awards and recognition

The bank has been widely recognized [undefined] for its transformation over the ten years between 2002 until 2012 for moving from a German-centric organization that was renowned for its retail and commercial presence to a global investment bank that is less reliant on its traditional markets for its profitability.

[undefined] Deutsche Bank was named International Financing Review's Bank of the Year twice in a three-year period, in 2003 and 2005.

It also won the prize in 2010.

[undefined] In 2012, for the second time in three years, Deutsche Bank was named Best Global Investment Bank in the annual Euromoney Awards for Excellence.

In December 2012, International Financing Review (IFR) recognized Deutsche Bank as its Equity House of the Year and Bond House of the Year 2012.

This is the first time the Bank has been named Equity House of the Year and the sixth time that it has won the top Bond award.

Deutsche Bank is also the only European bank to have been awarded the top Equity and Bond awards in the same year.

Highlighting the Bank's success in equities, IFR said: "Deutsche led major IPOs, took on tough risk positions (especially in Europe) and became one of the preferred banks of the US Treasury."

IFR also praised the Bank’s "fortitude and skill" in bond markets, saying it combined "a steady hand with solid execution to get all kinds of deals done in just about every corner of the globe."

Deutsche Bank won a further seven IFR awards:

Commodity Derivatives House

EMEA Structured Equity House

EMEA Loan House

EMEA High-Yield Bond House

EMEA Liability Management House

SSAR Bond House

Sterling Bond House

In 2016, Standard Ethics Aei assigned a rating to Deutsche Bank in order to include it in its Standard Ethics German Index. [undefined]

Management structure

When Deutsche Bank was first organized in 1870 there was no CEO.

Instead the board was represented by a speaker of the board.

Beginning in February 2012 the bank has been led by two co-CEOs, and in July 2015 it announced it will be led by one CEO from 2016.

The management bodies of Deutsche Bank

Annual general meeting

Management board

Supervisory board

Group executive committee

Management board

Management board members as of 12 February 2016:

John Cryan, chair and chief executive officer(sole CEO effective 20 May 2016)

Juergen Fitschen, co-chair, outgoing (departed 19 May 2016)

Stuart Lewis, chief risk officerSylvie Matherat, chief regulatory officer Quintin Price, Head of Deutsche Asset Management

Garth Ritchie, Head of Global Markets

Karl von Rohr, chief administrative officer*Dr.

Marcus Schenck, chief financial officer* Christian Sewing, Head of Private, Wealth & Commercial Clients

Jeffrey Urwin, Head of Corporate & Investment Banking

Supervisory board

Supervisory Board member as of 1 January 2013:

Paul Achleitner, chair

Karin Ruck, deputy chair, Senior Adviser Regional Transformation, Region Frankfurt/Hesse-East, Deutsche Bank AG, Member of the Combined Staff Council

Wolfgang Böhr, chair of the Combined Staff Council Düsseldorf, Member of the General Staff Council, Member of the Group Staff Council

Karl-Gerhard Eick (Management Consultant KGE Asset Management & Consulting Ltd.)

Katherine Garrett-Cox (chief executive officerof Alliance Trust PLC)

Alfred Herling, Chairman of the Combined Staff Council Wuppertal/Sauerland, Chairman of the General Staff Council, Chairman of the Group Staff Council

Henning Kagermann (president of Acatech – German Academy of Science and Engineering)

Martina Klee, chair of the Staff Council GTO Eschborn/Frankfurt, Member of the General Staff Council, Member of the Group Staff Council

Suzanne Labarge (previously vice chairman & chief risk officer, Royal Bank of Canada in Toronto)

Peter Löscher (chief executive officerof Renova Management AG)

Henriette Mark, chair of the Combined Staff Council Munich and Southern Bavaria, Member of the General Staff Council, Member of the Group Staff Council, Chairperson of the European Staff Council

Gabriele Platscher, chair of the Combined Staff Council Braunschweig/Hildesheim

Rudolf Stockem (trade union secretary to Vereinte Dienstleistungsgewerkschaft and freelance organisation and communication advisor)

Johannes Teyssen (chair of the management board of E.ON )

Marlehn Thieme, Director Infrastructure/Regional Management Communications Corporate Citizenship

Tilman Todenhöfer (managing partner Robert Bosch Industrietreuhand KG)

Klaus Rüdiger Trützschler (previously member of the management board of Franz Haniel & Cie.

GmbH)

Stefan Viertel, head of cash management financial institutions, Austria and Hungary, senior sales manager

Renate Voigt, Chairman of the Combined Staff Council Stuttgart/Esslingen/Heilbronn

Werner Wenning, (chair of the supervisory board of E.ON, chair of the supervisory board of Bayer AG)

Group executive committee (GEC)

The group executive committee comprises the members of the management board and senior representatives from the business divisions within the client-facing group divisions and from the management of the regions appointed by the management board.

The GEC serves as a tool to coordinate the businesses and regions.

It has, as its prime tasks and responsibilities, the provision of ongoing information to the management board on business developments and particular transactions, regular review of business segments, consultation with and furnishing advice to the management board on strategic decisions and preparation of decisions to be made by the management board.

Committee members as of 1 January 2013:

Juergen Fitschen, co-chair

Anshu Jain, co-chair

Stefan Krause, chief financial officer* Stephan Leithner, chief executive officerEurope (except Germany and UK), Human Resources, Legal & Compliance, Government & Regulatory Affairs

Stuart Lewis, chief risk officer* Rainer Neske, head of Private & Business Clients

Henry Ritchotte, chief operating officer* Melinda J. Hooker, chief executive officerof North America

Gunit Chadha, Co-chief executive officerof Asia/Pacific

Alan Cloete, Co-chief executive officerof Asia/Pacific

Michele Faissola, Head of Asset & Wealth Management

Colin Fan, co-head of Corporate Banking & Securities and Head of Markets

David Folkerts-Landau, head of research

Colin Grassie, chief executive officerof the UK

Robert Rankin, co-head of Corporate Banking & Securities and Head of Corporate Finance

Christian Ricken, chief operating officer, Private & Business Clients

Werner Steinmüller, head of Global Transaction Banking

Richard Walker, general counsel

Business divisions

Corporate and Investment Bank (CIB)

Deutsche Bank is considered among the "Bulge bracket" of global investment banks due to its leading size and profitability. The bank's business model rests on two pillars: the Corporate & Investment Bank (CIB) and Private Clients & Asset Management (PCAM).

The Corporate & Investment Bank (CIB) is Deutsche Bank's capital markets business.

CIB comprises two divisions, Corporate Banking & Securities and Global Transaction Banking.

Corporate Banking & Securities (CB&S)

Deutsche Bank's Corporate Banking & Securities division comprises Markets and Corporate Finance.

Markets

The Markets division is responsible for Deutsche Bank Group's sales and trading of securities.

Markets Research provides analyses of financial products, markets and strategy.

Corporate Finance

The Corporate Finance division is responsible for advisory, debt and equity issuances and mergers & acquisitions (M&A).

Global Transaction Banking

Global Transaction Banking or GTB caters for corporates and financial institutions by providing commercial banking products including cross-border payments, risk mitigation and international trade finance.

PCAM

Private Clients & Asset Management (PCAM) is composed of Private Wealth Management, Private & Business Clients and Asset Management.

This trio of business divisions include Deutsche Bank’s investment management business for private and institutional clients, together with retail banking activities for private clients and small and medium-sized businesses.

Private Wealth Management

Private Wealth Management functions as the bank's private banking arm, serving high-net-worth individuals and families worldwide. The division has a strong presence in the world's private banking hotspots, including Switzerland, Luxembourg, the Channel Islands, the Caymans and Dubai.

Private and Business Clients

Private & Business Clients (PBC) is the retail banking division of Deutsche Bank. Besides Germany, it has operations in seven other countries: Italy, Spain, Poland, Belgium, Portugal, India and China.

Asset Management

According to the Scorpio Partnership Global Private Banking Benchmark 2014 [undefined] the company had US$384.1bn of assets under management, an increase of 13.7% on 2013.

As of June 30, 2017, Deutsche Asset Management had €711 billion of assets under management according to the Deutsche Asset Management website [undefined]

Communication

In 1972, the bank created the world-known blue logo "Slash in a Square" – designed by Anton Stankowski and intended to represent growth within a risk-controlled framework. [undefined]

Controversies

Deutsche Bank in general as well as specific employees have frequently figured in controversies and allegations of deceitful behavior or illegal transactions.

As of 2016, the bank was involved in some 7,800 legal disputes and calculated 5.4 billion euros as litigation reserves, [undefined] with a further €2.2 billion held against other contingent liabilities.

Tax evasion

Six former employees were accused of being involved in a major tax fraud deal with CO2 emission certificates, and most of them were subsequently convicted.

It was estimated that the sum of money in the tax evasion scandal might have been as high as 850 million Euros.

Deutsche Bank itself was not convicted due to an absence of corporate liability laws in Germany.

Espionage scandal

From as late as 2001 to at least 2007, the bank engaged in covert espionage on its critics.

The bank has admitted to episodes of spying in 2001 and 2007 directed by its corporate security department, although characterizing them as "isolated."

[undefined] According to the Wall Street Journal's page one report, Deutsche Bank had prepared a list of names of 20 people who it wished investigated for criticism of the bank, including Michael Bohndorf (an activist investor in the bank) and Leo Kirch (a former media executive in litigation with bank). [undefined] Also targeted was the Munich law firm of Bub Gauweiler & Partner, which represents Kirch. According to the Wall Street Journal, the bank's legal department was involved in the scheme along with its corporate security department. [undefined] The bank has since hired Cleary Gottlieb Steen & Hamilton, a New York law firm, to investigate the incidents on its behalf. The Cleary firm has concluded its investigation and submitted its report, which however has not been made public. [undefined] According to the Wall Street Journal, the Cleary firm uncovered a plan by which Deutsche Bank was to infiltrate the Bub Gauweiler firm by having a bank "mole" hired as an intern at the Bub Gauweiler firm. The plan was allegedly cancelled after the intern was hired but before she started work. [undefined] Peter Gauweiler, a principal at the targeted law firm, was quoted as saying "I expect the appropriate authorities including state prosecutors and the bank's oversight agencies will conduct a full investigation." [undefined]

In May 2009, Deutsche Bank informed the public that the executive management had learned about possible violations which occurred in past years of the bank's internal procedures or legal requirements in connection with activities involving the bank's corporate security department.

Deutsche Bank immediately retained the law firm Cleary Gottlieb Steen & Hamilton in Frankfurt to conduct an independent investigation [undefined] and informed the German Federal Financial Supervisory Authority (BaFin). The principal findings by the law firm, published in July 2009, [undefined] are as follows: Four incidents that raise legal issues such as data protection or privacy concerns have been identified. In all incidents, the activities arose out of certain mandates performed by external service providers on behalf of the Bank's Corporate Security Department. The incidents were isolated and no systemic misbehaviour has been found. And there is no indication that present members of the Management Board have been involved in any activity that raise legal issues or have had any knowledge of such activities. [undefined] This has been confirmed by the Public Prosecutor’s Office in Frankfurt in October 2009. [undefined] Deutsche Bank has informed all persons affected by the aforementioned activities and expressed its sincere regrets. BaFin found deficiencies in operations within Deutsche Bank's security unit in Germany but found no systemic misconduct by the bank. [undefined] The Bank has initiated steps to strengthen controls for the mandating of external service providers by its Corporate Security Department and their activities. [undefined]

April 2015 Libor scandal

On 23 April 2015, Deutsche Bank agreed to a combined US$2.5 billion in fines – a US$2.175 billion fine by American regulators, and a €227 million penalty by British authorities – for its involvement in the Libor scandal uncovered in June 2012.

The company also pleaded guilty to wire fraud, acknowledging that at least 29 employees had engaged in illegal activity.

It will be required to dismiss all employees who were involved with the fraudulent transactions.

However, no individuals will be charged with criminal wrongdoing.

In a Libor first, Deutsche Bank will be required to install an independent monitor.

Commenting on the fine, Britain's Financial Conduct Authority director Georgina Philippou said "This case stands out for the seriousness and duration of the breaches ... One division at Deutsche Bank had a culture of generating profits without proper regard to the integrity of the market. This wasn't limited to a few individuals but, on certain desks, it appeared deeply ingrained." The fine represented a record for interest rate related cases, eclipsing a $1.5 billion Libor related fine to UBS, and the then-record $450 million fine assessed to Barclays earlier in the case. The size of the fine reflected the breadth of wrongdoing at Deutsche Bank, the bank's poor oversight of traders, and its failure to take action when it uncovered signs of abuse internally.

Role in 2007/2008 financial crisis

In January 2017, Deutsche Bank agreed to a $7.2 billion settlement with the U.S. Department of Justice over its sale and pooling of toxic mortgage securities in the years leading up to the 2008 financial crisis. As part of the agreement, Deutsche Bank was required to pay a civil monetary penalty of $3.1 billion and provide $4.1 billion in consumer relief, such as loan forgiveness. At the time of the agreement, Deutsche Bank was still facing investigations into the alleged manipulation of foreign exchange rates, suspicious equities trades in Russia, as well as alleged violations of U.S. sanctions on Iran and other countries. Since 2012, Deutsche Bank had paid more than 12 billion euros for litigation, including a deal with U.S. mortgage-finance giants Fannie Mae and Freddie Mac. [undefined]

2015 sanctions violations

On 5 November 2015, Deutsche Bank was ordered to pay US$258 million (€237.2 million) in penalties imposed by the New York State Department of Financial Services and the United States Federal Reserve Bank after the bank was caught doing business with Burma, Libya, Sudan, Iran, and Syria which were under US Sanctions at the time. According to the US federal authorities, Deutsche Bank handled 27,200 US dollar clearing transactions valued at more than US$10.86 billion (€9.98 billion) to help evade US sanctions between early 1999 until 2006 which are done on behalf of Iranian, Libyan, Syrian, Burmese, and Sudanese financial institutions and other entities subject to US sanctions, including entities on the Specially Designated Nationals by the Office of Foreign Assets Control. [undefined] [undefined]

In response to the penalties, the bank will pay US$200 million (€184 million) to the NYDFS while the rest (US$58 million; €53.3 million) will go to the Federal Reserve. In addition to the payment, the bank will install an independent monitor, fire six employees who were involved in the incident, and ban three other employees from any work involving the bank's US-based operations. [undefined] The bank is still under investigation by the US Justice Department and NYDFS into possible sanctions violations relating to the 2014–15 Ukrainian crisis and its activities within Russia. [undefined]

2017 money-laundering fine

In January 2017, the bank was fined $425 million by the New York State Department of Financial Services (DFS) [undefined] and £163 million by the UK Financial Conduct Authority [undefined] regarding accusations of money laundering $10 billion out of Russia. [undefined] [undefined] [undefined]

Acquisitions

Morgan, Grenfell & Company, 1990.

Bankers Trust, 30 November 1998. [undefined]

Scudder Investments, 2001

RREEF [undefined] (Rosenberg Real Estate Equities Fund, founded in 1975), 2002 [undefined]

Berkshire Mortgage Finance, 22 October 2004.

Chapel Funding (now DB Home Lending), 12 September 2006 [undefined]

MortgageIT, 3 January 2007 [undefined]

Hollandsche Bank-Unie – 2 July 2008: Fortis, ABN AMRO and Deutsche Bank announced that they have signed an agreement by which Deutsche Bank would acquire from ABN AMRO its Hollandsche Bank-Unie subsidiary which concentrated on commercial banking activities in the Netherlands. The deal was initially put on hold when the Dutch government bailed out and took control of Fortis Bank Nederland. However the deal was later cleared and the subsidiary was purchased by Deutsche Bank for EUR 709 million in 2010.

Sal. Oppenheim, 2010

Deutsche Postbank, 2010 [undefined]

Notable current and former employees

Hermann Josef Abs – chair (1957–68)

Josef Ackermann – former CEO (2002–12)

Michael Cohrs – head of Global Banking (2002–2010)

Sir John Craven – financier in London

Alfred Herrhausen – chair (1988–89)

Anshu Jain – head of Corporate and Investment Banking

Henry Jackson – founder of OpCapita

Karl Kimmich – chairm (1942–45)

Georg von Siemens – co-founder and director (1870–1900)

Ted Virtue [undefined] – executive board member

Hermann Wallich – co-founder and director (1870–1893)

Greg Lippmann – trader

Boaz Weinstein – derivatives trader

Clive R. Holmes – co-founder, co-managing partner and chief investment officerof The Silverfern Group [undefined]

Public service

Sajid Javid – former board member of Deutsche Bank International Limited (2007–2009)

Otto Hermann Kahn – philanthropist

Awards

Best Banking Performer, Germany in 2016 by Global Brands Magazine Award.

See also

European Financial Services Roundtable

Deutsche Bank Prize in Financial Economics